1

Livelihoods Survey Report

November 2023

Contents

1.Introduction.....................................................................................................................................2

1.2. Problem Statement ..................................................................................................................2

1.3. The Aim of the Study ...............................................................................................................2

1.4. How do VSLAs work?...............................................................................................................2

2.Literature Review............................................................................................................................3

2.1. The Concept of Sustainable Livelihoods..................................................................................3

2.2. Understanding the Pro-poor Microfinance.............................................................................4

2.3. Poverty and VSLAs ...................................................................................................................5

3.Methodology...................................................................................................................................7

4.Findings............................................................................................................................................7

4.1. Participants ..............................................................................................................................8

4.2. Main Sources of Household Incomes......................................................................................8

4.3. Average Quarterly Business Incomes......................................................................................9

4.4. Average Use of VSLA and Business Incomes...........................................................................9

5.Discussion......................................................................................................................................10

6.Conclusion.....................................................................................................................................11

References.............................................................................................................................................12

2

1.Introduction

Globally, subsistence and smallholder farmers and in particular, women contribute in diverse ways

to agricultural production and food security. Despite this role of agriculture, subsistenceand

smallholder farmers face enormous challenges with regards to access to production capital and

especially production credit. In striving to enhance smallholder farmers’ access to production capital,

several non-governmental organisations are integrating and institutionalising the use community-

based and informal financial services institutions. Through the support by these rural development

agencies, many of these farmers participate in Farmer Learning Groups (FLGs) and Village Savings

and Loans Associations (VSLAs). VSLAs are essential in bringing some financial services to

populations where access is scarce. Mahlathini Development Foundation (MDF) carried out an

investigation to find out the usefulness and contribution of VSLAs to entrepreneurial activities and

average capital injections into farming business and related enterprises. Data was collected from 65

members of FLGs in KwaZulu-Natal and Limpopo provinces. This report dissects the extent to

which members of the Farmer Learning Groups (FLGs) use Village Savings and Loans

Associations (VSLA) to improve household livelihoods – in terms of acquiring assets and

operating income generating activities.

1.2.Problem Statement

Informal financial institutions such as VSLAs are known for their ability to resolve scarcity of cash in

underdeveloped communities. These institutions help their members to manage cash-flow in ways

that mitigate the consequences of poverty. This is because these informal financial institutions are

able to mobilise huge savings and loan funds that are circulated in the economy. However, despite

substantial savings that are circulated by VSLAs in local economies, the extent to which members

use their drawings for productive purposes remains blurred.

1.3.The Aim of the Study

The study explored the usefulness and contribution of VSLAs to entrepreneurial activities and

average capital injections into farming and related enterprises. The study employed the Sustainable

Livelihoods Framework (Scoones, 1993; Chambers & Conway, 2002), to understand types of income

generating activities (IGAs) that are mostly operated by members of FLGs, and the extent to which

members of the FLGs use their VSLAs to finance their production activities.

1.4.How do VSLAs work?

Members or users of a VSLA make regular contributions to self-capitalise, that is, to build a group

fund. Users do this by committing on making regular deposits of varying amounts to build the group

fund. The most dominant practice in South Africa is that VSLAs meet at least once a month to

3

conduct their business. The group fund is then used to provide microloans to internal borrowers at

an agreed interest rate. At the end of a savings cycle, which is usually a year; a VSLA would dissolve

and distribute its group fund proportionally to the deposits of individual members. This means that

all the money in the group fund, which includes savings, interest and fines is paid out to the

members proportionally to their savings at the end of the savings cycle.

2.Literature Review

2.1.The Concept of Sustainable Livelihoods

The concept of Sustainable Livelihoods (SL) stems from the advisory panel of the World Commission

on Environment and Development (WCED, 1987). Since then, the Sustainable Livelihood Approach

(SLA) has been widely used to guide development policy, research and execution and performance

monitoring of development projects.

The widely accepted assertion is that,

“a livelihood comprises the capabilities, assets (stores, resources, claims and access) and

activities required for a means of living” (Chambers & Conway, 1992, p. 6).

In most basic terms, Chambers and Conway (1992) assert that,

“a livelihood is sustainable when it can cope with and recover from stresses and shocks,

maintain or enhance its capabilities and assets, and provide sustainable livelihood

opportunities for the next generation; and which contributes net benefits to other

livelihoods at the local and global levels and in the short and long term” (p. 7).

This assertion makes SLA an analytical framework that can be used in almost all phases of a

development project. The significance of the SLA is its ability to move beyond the analysis of income

and taking into consideration all signs and symptoms of poverty, social exclusion and vulnerability

(Krantz, 2001). The SLA puts people at the centre of their development, and it recognises that poor

people are the best at knowing their own problems and developing solutions that help them to

resolve challenges they face (ibid). The SLA has been used as an analytical framework for the study

for at least three main objectives.

•Firstly, SLA has been used by many international organisations such as United Kingdom’s

Department for International Development (DFID), OXFAM, CARE and many others for planning

their development programmes (Carney et al., 1999).

•Secondly, SLA has been used as a set of guiding principles and as an analytical framework to

guide development programmes (Allison & Horemans, 2006).

•Lastly, SLA has also been used to assess the extent development activities fit into the livelihoods

of the poorfor the purposes of helping development organisations to improve their monitoring,

evaluation, reflection and learning frameworks and programmes (Kollmair, 2000).

4

These three elements of the SLA have been brought together and framed as an analysis tool that is

used to understand the complexity of poverty and development. This analysis tool is referred to as

the Sustainable Livelihood Framework (SLF). The SLF recognises at least three types of capital that

are most relevant for the study. These are financial capital, social capital and human capital (DFID,

2001). In the context of SLF, social capital includes all the social resources at one’s disposal to use to

implement livelihood objectives. In the instance of a FLGs and VSLAs, the use of networks,

relationships, membership and connectedness tend to increase levels of trust that are essential for

working together (ibid) and strengthen human capital. For the VSLA to operate optimally, it requires

knowledge, talent and skills that are provided by healthy and enabled bodies. VSLA is described as a

key financial resource together with other regular inflows of money for multiple sources of income.

Livelihood strategies and livelihood outcomes are the most important components of the SLF. A

livelihood strategy is a combination of choices and activities that people undertake to achieve the

planned and desired outcomes (Kollmair & Gamper, 2002). A livelihood outcome is essentially the

achievement of a livelihood strategy such as food security, more income streams, more money,

access to services, etc. – where a combination of livelihood outcomes reduce vulnerability.

This study used the SLF as the main lens to explore types of IGAs that are mostly operated by

members of FLGs, and the extent to which members of the FLGs use their drawings received from

the VSLAs to finance their production activities.

2.2.Understanding the Pro-poor Microfinance

The purpose of this section is to describe the relationship between microfinance programming and

VSLAs. In under-serviced populations and settlements, decentralised and member-owned informal

financial institutions are often the most responsive financial services providers. The analysis of

microfinance is drawn mainly from the observations Rutherford (2000), Dichter (2006), Ditcher and

Happer (2007) and Bateman (2010). The study gives credit to the experience of the Grameen Bank.

The significance of the Grameen Bank is that it was able to attract ideas, approaches and models for

planning and delivery of microfinance interventions around the world. The experiences and lessons

learnt from the 1950 and in particular the unpalatable consequences of microcredit programmes

saw the emergence of microfinance as a concept that embraces the provision of a basket of financial

services to the poor and vulnerable populations.

Stuart Rutherford worked with poor people in the slums of Dhaka for over 20 years. He documented

their experiences with regards to their sources of incomes, their relationship with money and what

their expenses. He conducted his research in selected settlements in South Africa, Bangladesh and

India by collecting household financial transactions on fortnightly basis for nearly a decade. He

subsequently published an essay in 2000 entitled ‘The Poor and their Money’. Rutherford argues

that poor people need greater than their usual sums of money from multiple income streams in

order to meet life-cycle events; to guard themselves against risk and to seize income generating

opportunities (Rutherford, 2000). Ditcher and Happer (2007) align with the observation made by

Rutherford (2000) by emphasizing that drawings made from VSLAs and other community-based

5

informal financial schemes are largely used for consumption purposes and purchasing of household

assets.

Dichter (2006) raises a concern of the “paradox of microcredit”. He argues that microcredit provides

little capital for poor people to operate profitable enterprises. A similar concern is extended by

Bateman (2010) who maintains that microfinance programmes that are designed to lift poor and

vulnerable populations out of poverty actually reinforce poverty they are set to eliminate. Further to

this, Bateman and Chang (2012) argue that the microfinance model traps poor into poverty because

community-based informal financial institutions fail to provide enough investment capital for low-

income earners to succeed in a saturated informal economy.

The battle between promoters and detractors of microfinance programmes is an obvious one. In this

instance, promoters are convinced that microfinance programmes help to fight poverty while the

detractors on the other side argue that there is evidence that suggests microfinance programmes

are reproducing poverty. The debates within the microfinance sector do not concern this study.

However, the impact of VSLA programmes and self-capitalised community-based informal

institutions is acknowledged. This is because self-capitalised informal financial institutions continue

to provide financial services to millions of low-income earners outside the mainstream financial

institutions.

In conclusion, VSLAs cannot escape disputes taking place within the microfinance sector in general.

Opportunities for harnessing collective strength of VSLAs, their knowledge construction and practice

may be under-imagined, undermined or unexplored. Such critique presents the need for further

research in this sector – and in this instance, to explore the extent VSLAs contribute into broad-

based economic development objectives within the food system and agricultural value chains.

2.3.Poverty and VSLAs

Many underserved populations in South Africa and in particular rural communities are characterized

by theatres of socio-economic hardships and poverty resulting from hundreds of years of oppression

and marginalisation. Lack of access to usable financial services appears to be the most frustrating

feature besetting life improving efforts mainly in underserved rural settlements. This section brings

forth the argument that institutions of power exhibit financial practice that systematically

marginalise and exclude low-income earners from access to financial instruments that will allow

them to live better.

Today, the importance of VSLAs is that they provide essential financial services mostly to low-income

earners that are either not served or inconvenienced by formal financial institutions. Scarcity of

cash, and/or poor circulation of cash is the main feature of rural settlements. Scarcity of cash is a

direct consequence of sustained financial marginalisation by the institutions of power, mainly the

state and financial institutions.

6

“Men and women say they need credit, not only to improve their livelihoods and for

emergencies but also sometimes for daily expenditure during difficult times. When networks

of relatives and friends are not sufficient, poor people say that, to survive, they frequently

turn to moneylenders, shopkeepers and pawnbrokers.”

(Chambers et al. 2000, p. 56)

The above quotation expresses the frustrations of poor people and what they use financial services

for. The significance of VSLAs is that they provide alternative and convenient platforms for low-

income earners to save and build pools of capital funds that they use to provide micro-loans and

lump sum pay-outs at the end of saving cycles. In this way low-income earners participating in VSLAs

are able to resolve some of their financial challenges that are constantly reproduced by the scarcity

of cash. Basically, VSLAs improve capabilities of the poor to build assets that help them to survive

misfortunes as expressed by Chambers and Conway (1992) in their SLF. VSLAs help users mitigate

and/or prevent exposure to vulnerability. Dercon (2001) describes vulnerability to be:

“…determined by the options available to households and individuals to make a living, the

risks they face and their ability to handle these risks.” (Dercon, 2001, p. 27)

The exposure to vulnerability is expressed by the options available to individuals to take specific

actions that mitigate consequences of risks they face. In the eyes of poor people, receiving financial

services from their VSLAs reduces exposure to their vulnerability and presents the much needed

safety nets for surviving poverty.

People define and decide the course of their development. However, the financial services

environment remains complex for many. Its complexity tends to constrain full access of users of

VSLAs to financial services and wealth-building instruments (Mader, 2015). Basically, South African

banks only offer limiting transactional accounts for member-owned informal financial institutions,

and mainly the stokvels. These accounts are usually emptied at the end of savings cycle which is

usually a year. The largest majority of VSLAs, savings group, savings clubs and stokvelsoperate in

twelve months cycles, and always start at zero after depleting entire group fund. This practice tend

to throw users of VSLAs into perpetual non-productive consumption. The depletion of pools of

savings in annual cycles keeps low-income earners distracted from wealth-building financial

instruments.

The theoretical approach of sustainable livelihoods cannot be complete without reflecting on the

concept of community development. There are several contestations around the concept of

community development and what it represents (Watt, 2016). The first approach to community

development has attracted a lot of controversy mainly from the African intellectuals. According to

Watt (2016), international community and national governments have developed instruments of

community development that are mostly imposed on communities resulting in unimaginable

violations of communities by public officials and their handlers. This is community development that

is disempowering and marginalising (Swanepoel and De Beer, 2006) as it is designed to maintain the

oppressive status quo. According to Hauser and Freire (2002) and Burke (2010), empowering

community development is characterised by collective action and communities taking the lead,

7

responsibility and full ownership of development phases and actions. Makuwira (2006) notes that

full participation of all stakeholders and communities underpins the theory of people-centred

development (World Bank, 1996) through which community resources including human capacities

are mobilised to deliver on socio-economic development objectives of their localities. It is in this way

that local people are able to determine their own futures.

In conclusion, the main highlights noted from the supporters of community-based microfinance

programmes such as Rutherford (2000), Allen (2007) in Ditcher and Happer (2007), Allen and

Panetta (2010), Markel and Panetta (2014), Ngcobo (2018) and others all promote the positive

impact VSLAs have made with regards to consumption smoothing, betterment of dwellings, income

generating initiatives, and generally, the ability to meet the demands of life-cycle events.

3.Methodology

The study was located within the interpretive paradigm. This is because the study sought a deeper

understanding of how the members of FLGs experienced the use of financial services that are

provided by their VSLAs for productive purposes. Purposive sampling was used to identify

participants. The sample was made up of 65 members of FLGs.

According to Morse and McNamara (2013), the SLA accommodates data tools such as interviews,

observation and participatory methods to assess vulnerability and impact of development initiatives.

The study commenced with focus group discussions and was followed by semi-structured interviews

as data generation methods. A focus group discussion is a qualitative data collection tool. It is a

structured and facilitated in-depth discussion. It is usually led by an experienced moderator who is

able to encourage participants to engage freely. It is typically carried out by a small group roughly

between 6 – 10 people with similar backgrounds for the purpose of discussing a specific topic of

interest and to provide useful insights on the topic.

Semi-structured interviews were used to supplement focus group discussions. Semi-structured

interviews allowed the exploration of the experiences the perceptions of participants. Semi-

structured interviews were chosen because they promote natural conversations (Duranti, 2011) and

flexibility to use open-ended questions and to craft on the spot follow-up questions during the

interview (Neergaard & Leitch, 2015). Thematic content analysis which is a descriptive analysis of

data was used. The significance of thematic content analysis is that it ensures that the experiences

and voices of the research participants remain at the centre of the findings.

4.Findings

The purpose of this section is to present findings of the study. The main objective of this study was

to better understand the extent users of VSLAs use their drawings to support their productive

activities including financing their enterprises. The SLF was used as a tool of analysis to help

understand how a VSLA as a livelihood strategy interact with livelihood activities.

8

4.1.Participants

The study was conducted in Emmaus, Appelsbosch, Nokweja and Centocow in KwaZulu-Natal

province, and Worcester, Turkey-2, Madeira and Sedawa in the Limpopo province.

Participants

KZN

Limpopo

Total

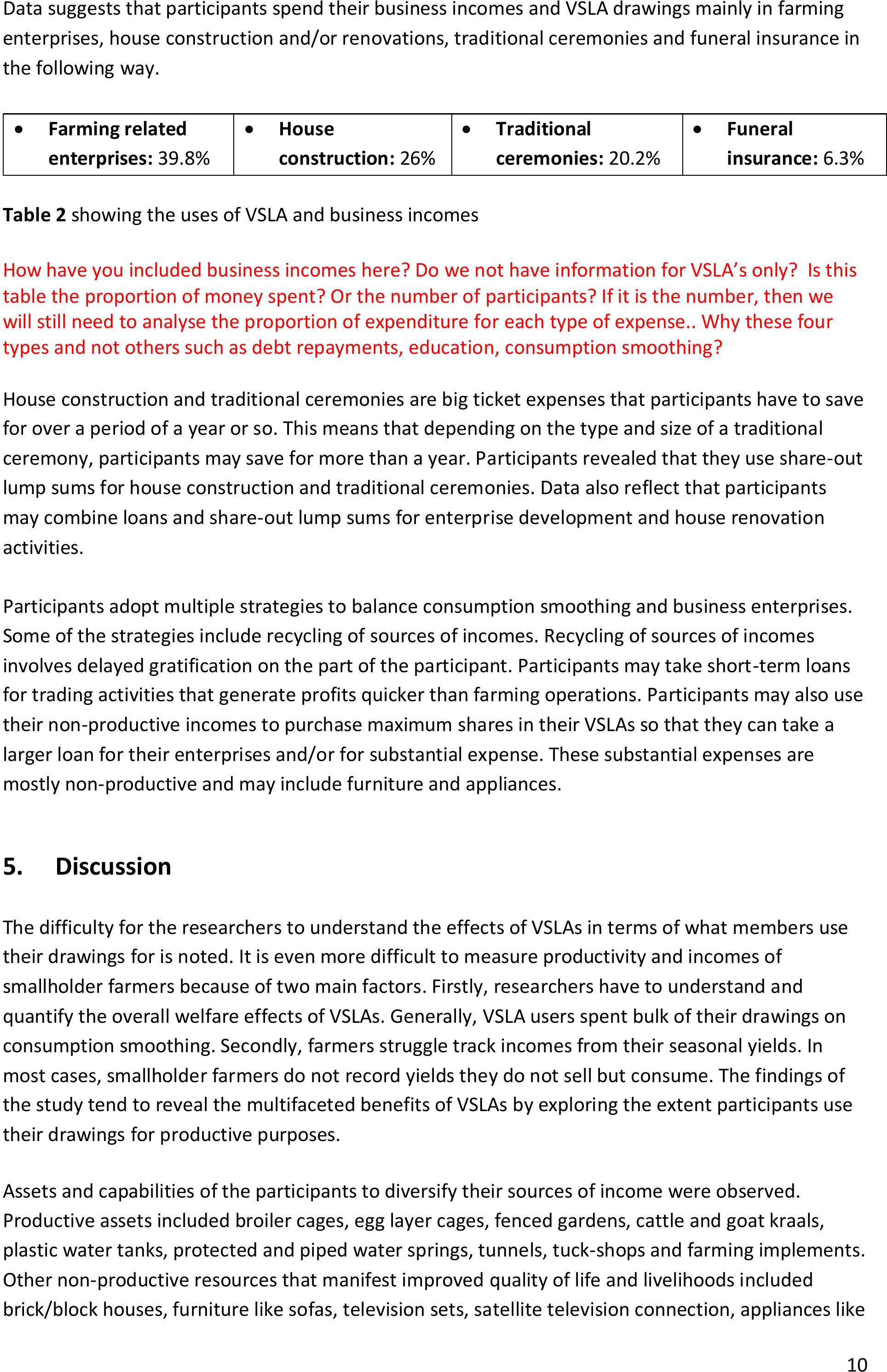

The largest majority of participants in

the FLGs (88%) are adult women and

only 12% are men – and both men and

women living in rural communities.

56

9

65

Women

50

7

57

Men

6

2

8

Table 1 showing the number of participants

What happened to the respondents not in VSLAs??

Active participation of rural women in FLGs suggests that women are the key players in food

production and food security. This finding aligns with the findings of IFAD (2019) that over 50% of

the women across the globe are active food producers and just over 60% of rural women in Africa

depend on agriculture to generate household incomes. Despite this role in food production, women

face enormous challenges that continue to constrain their development. One of the challenges is

access to financial services and in particular production credit. Data reveals that VSLAs are

increasingly becoming the most preferred alternative with regards to saving and borrowing.

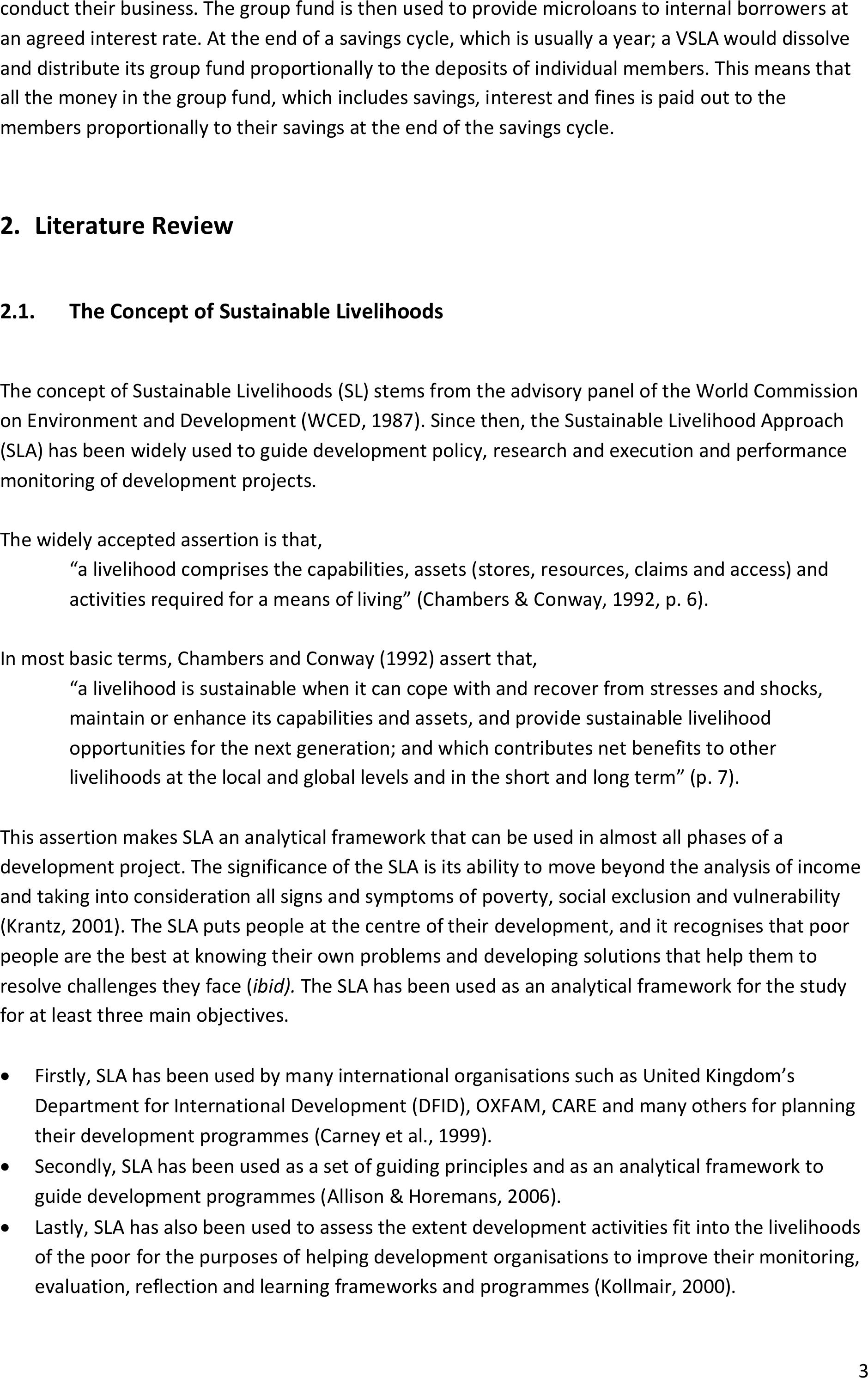

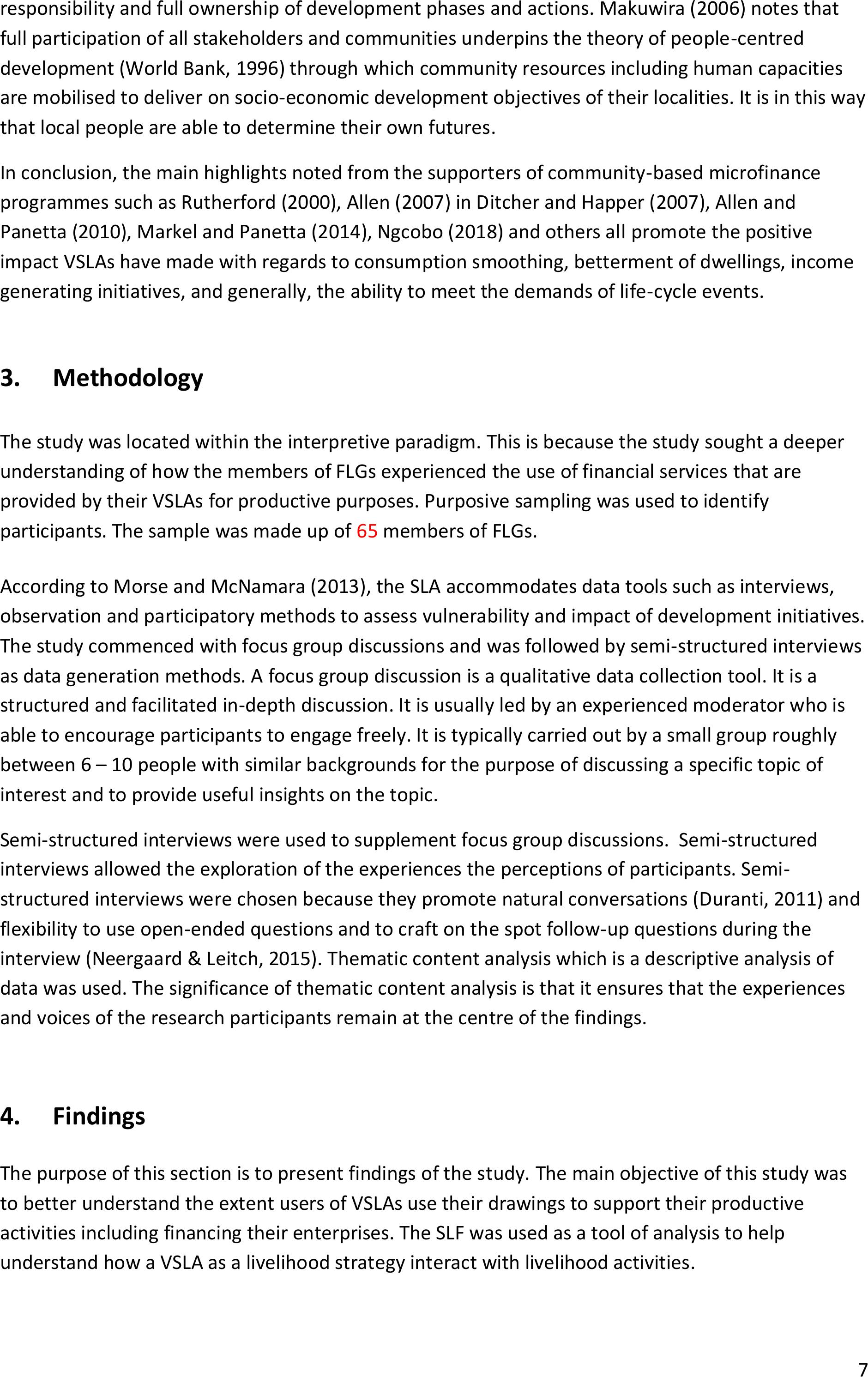

4.2.Main Sources of Household Incomes

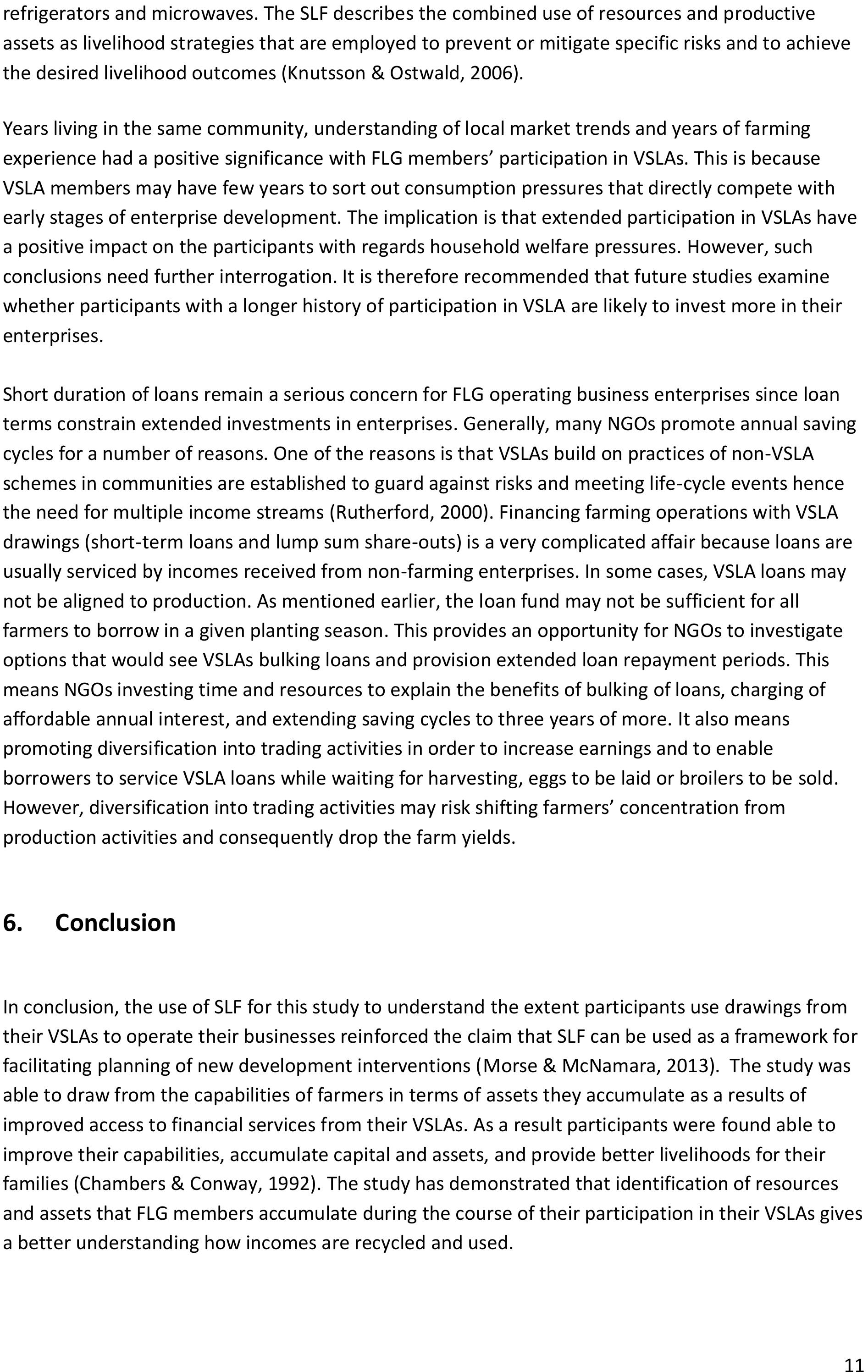

Data reveals that about 85.7%

of participants are involved in

business enterprises. Data also

suggests that 30.4% and 21.4%

receive their incomes from

state grants and remittances

respectively. Some portions of

these incomes are recycled and

used to capitalise village-based

enterprises.

Graph 1 showing main sources of income

To understand the low reliance on state grants (30,4%), as it is usually >80% in rural areas, would be

to look at the age distribution of respondents- as this will give us an idea also of our “missing

middle” group and their pre-dominance in running enterprises…

Also, don’t they have multiple sources?

The main income generation activities or village-based enterprises include:

30.4% 21.4%

7.1%

85.7%

8.9%

State grantsRemittancesFulltime

worker

Running

enterprise

Misc

9

•60% of the participants use farming to generate their household incomes. In the main they

produce vegetables, maize and other field crops, broilers and eggs.

•Around 12% of the participants manufacture grass mats, beads, garments and scones and cakes.

•Lastly, about 22% of the participants are involved in general trading which includes re-selling of

clothes, food vending and operating small retail shops known as tuck-shops in South Africa.

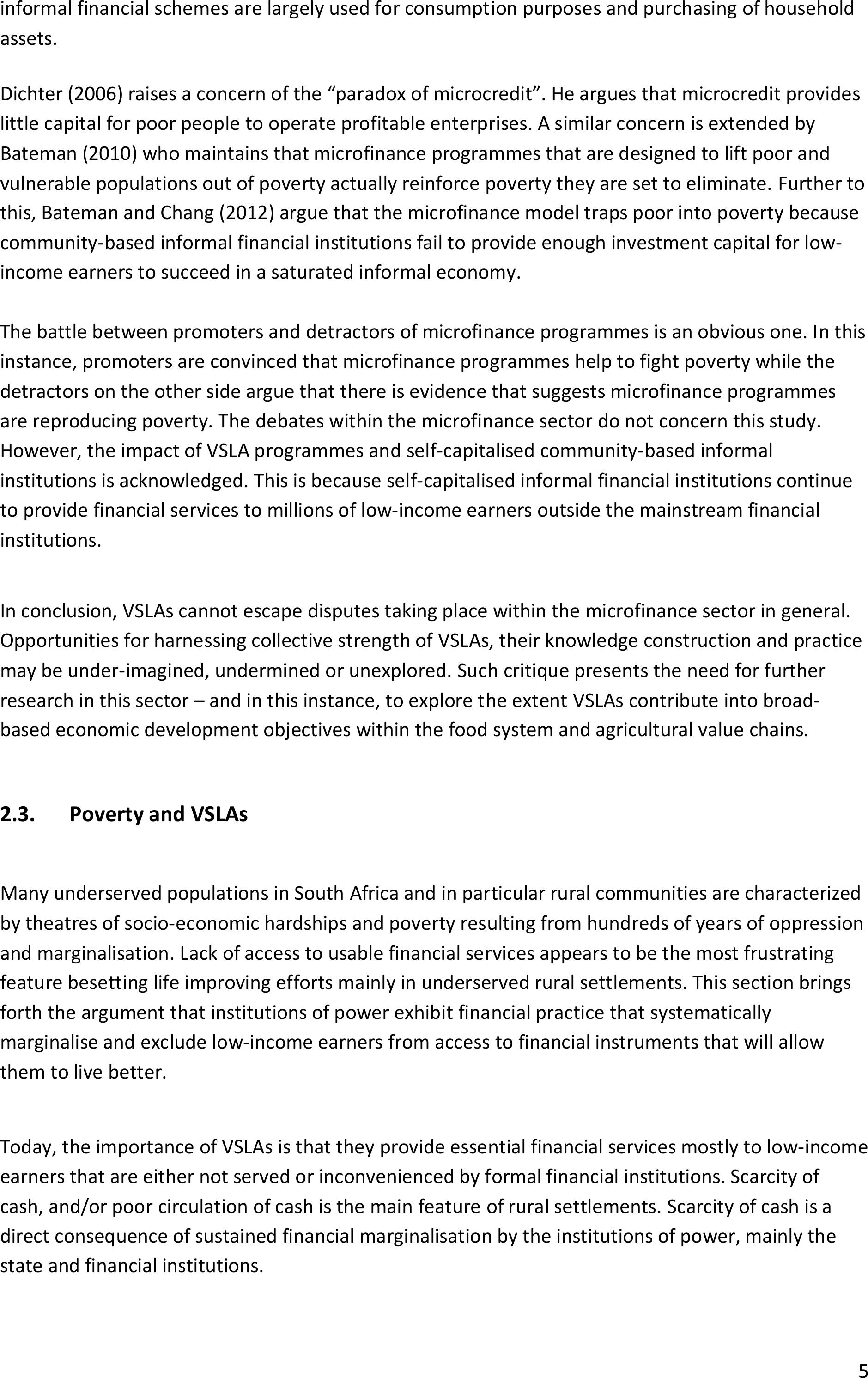

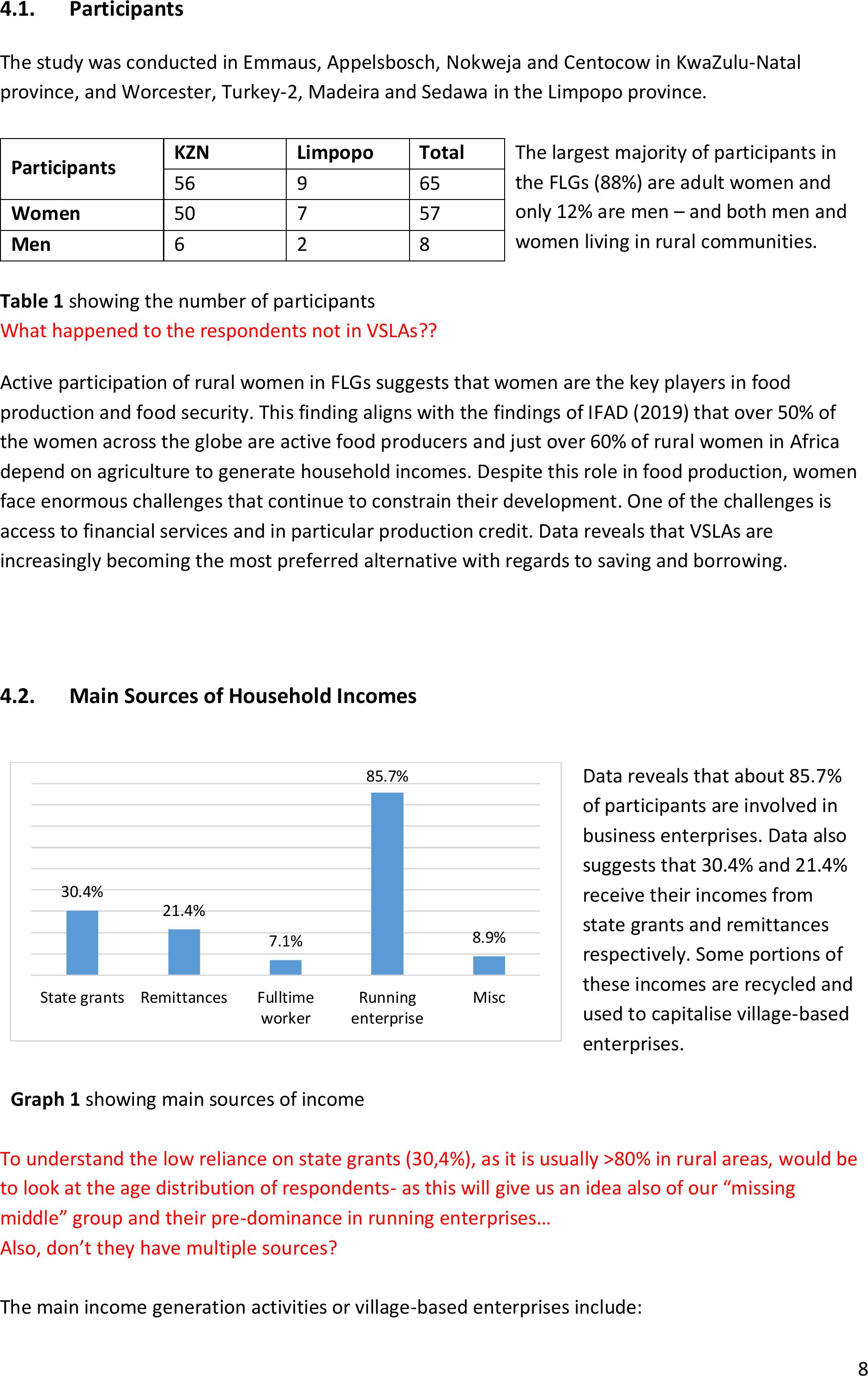

4.3.Average Quarterly Business Incomes

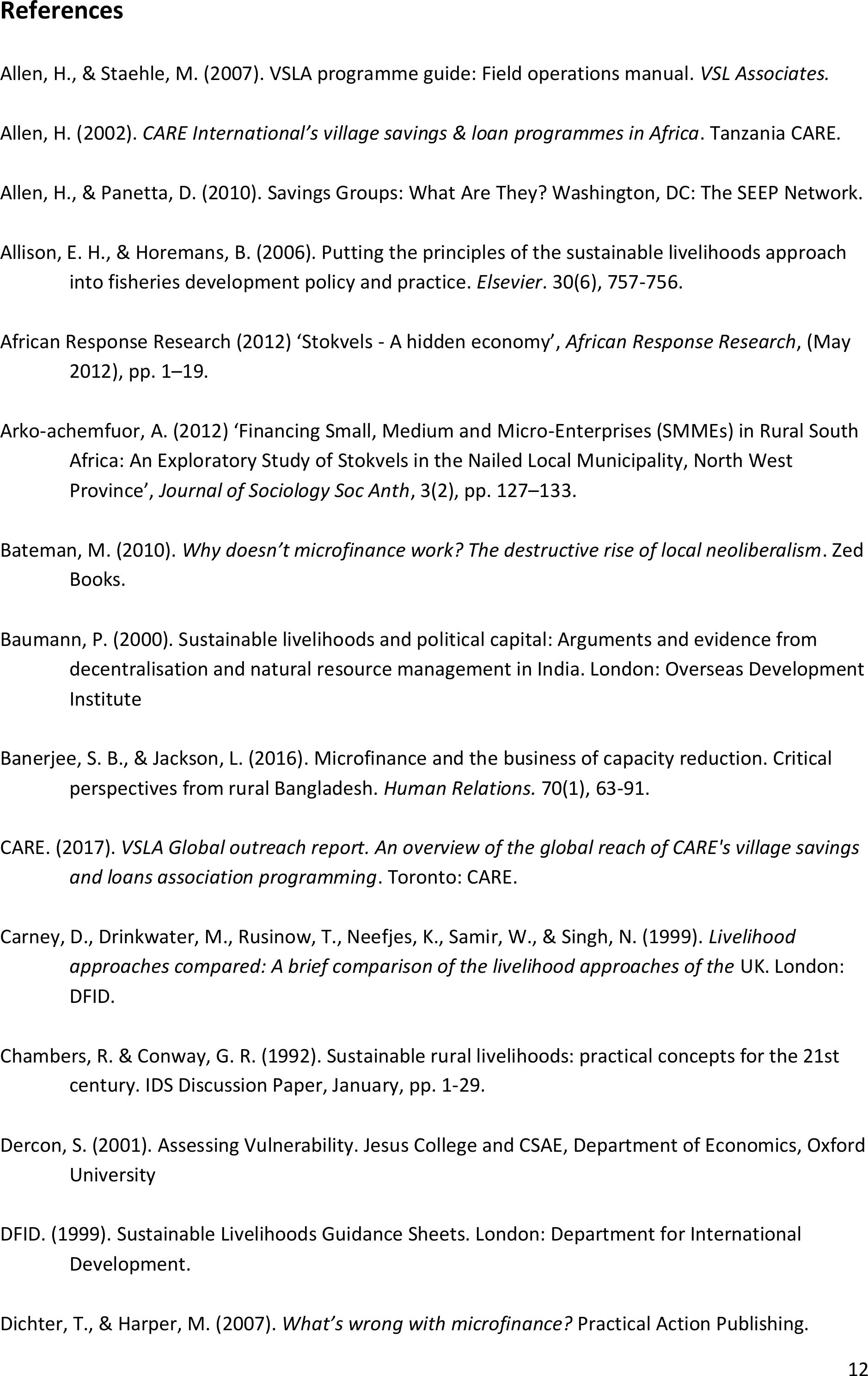

Graph 2 showing average quarterly incomes

Data suggests that participants receive about R10 162 annual income fromnon-business activities

which includes state welfare grants and remittances. But in the earlier graph this is only 30% of the

respondents??? Is this average across all respondents or only those receiving grants?

Some of this non-business income empowers the participants to pay their regular contributions to

their respective VSLAs. Participation in VSLAs gives them access to short-term loans during a saving

cycle and lump sum share-outs at the close of a saving cycle. Data shows that participants receive an

average of R6 500 from their VSLAs in the form of loans and share-out lump sums. Some portions of

non-business income and VSLA drawings are used to finance business enterprises.On average, an

enterprise operator receives a quarterly income of R8 561 which adds up to R34 244 annual income

from a farming operation. In addition, some enterprise operators would generate about R1 750 non-

farming activities such as trading, and about R1 706 from manufacturing and services, also on

quarterly basis.

Do respondents have more than one enterprise such as farming, retail and non-farming - how does

this impact on their annual incomes??? I think this will help in the argument around diversification of

livelihoods showing that those that diversify are better off than those who don’t???

4.4.Average Use of VSLA and Business Incomes

71%

15% 14%

Average quaterly farming

business income: R8 561

Average quaterly non-farming

retailing business income: R1

750

Average quaterly non-farming

manufacturing and services

business income: R1 706

10

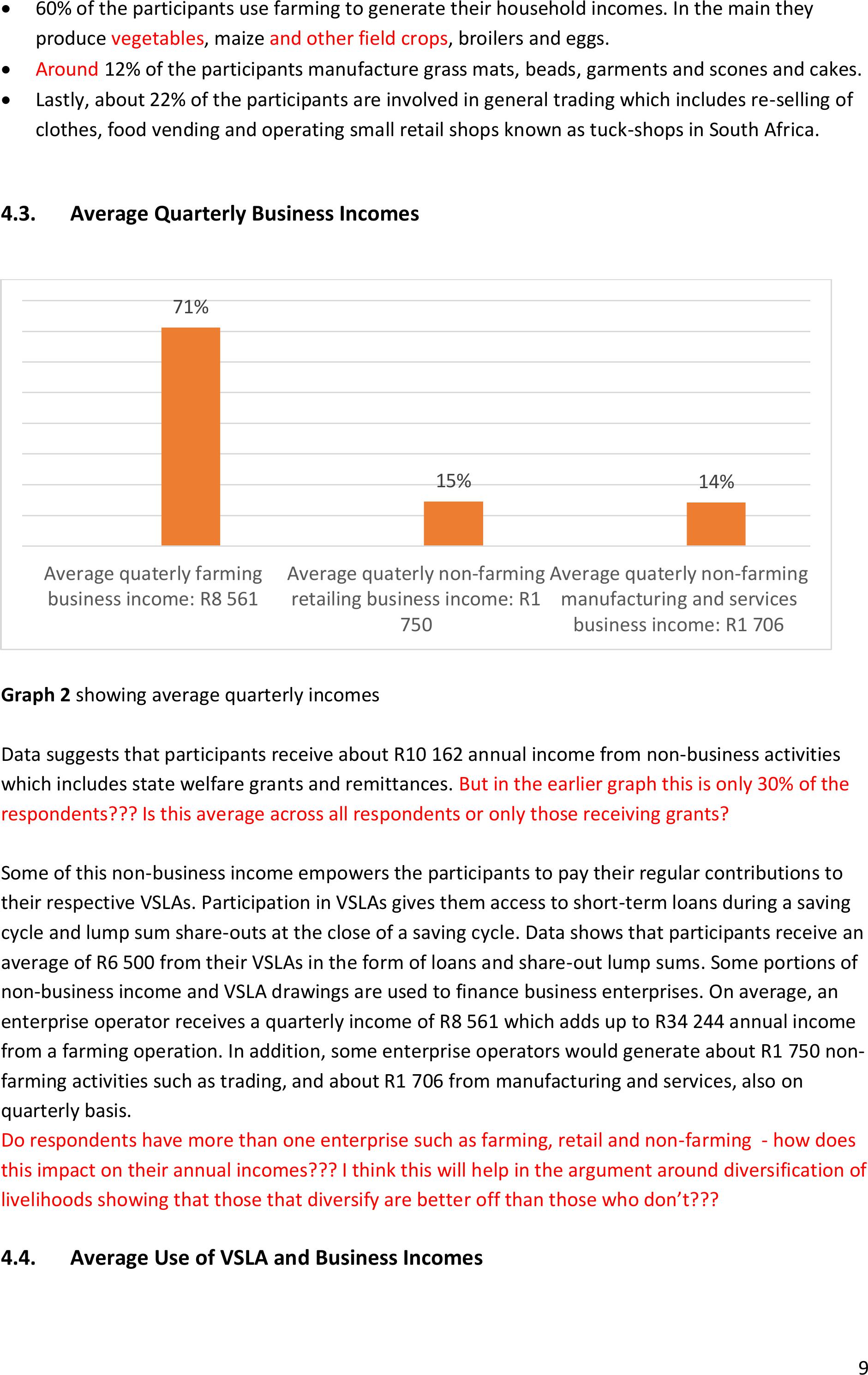

Data suggests that participants spend their business incomes and VSLA drawings mainly in farming

enterprises, house construction and/or renovations, traditional ceremonies and funeral insurance in

the following way.

•Farming related

enterprises: 39.8%

•House

construction:26%

•Traditional

ceremonies: 20.2%

•Funeral

insurance: 6.3%

Table 2 showing the uses of VSLA and business incomes

How have you included business incomes here? Do we not have information for VSLA’s only? Is this

table the proportion of money spent? Or the number of participants? If it is the number, then we

will still need to analyse the proportion of expenditure for each type of expense.. Why these four

types and not others such as debt repayments, education, consumption smoothing?

House construction and traditional ceremonies are big ticket expenses that participants have to save

for over a period of a year or so. This means that depending on the type and size of a traditional

ceremony, participants may save for more than a year. Participants revealed that they use share-out

lump sums for house construction and traditional ceremonies. Data also reflect that participants

may combine loans and share-out lump sums for enterprise development and house renovation

activities.

Participants adopt multiple strategies to balance consumption smoothing and business enterprises.

Some of the strategies include recycling of sources of incomes. Recycling of sources of incomes

involves delayed gratification on the part of the participant. Participants may take short-term loans

for trading activities that generate profits quicker than farming operations. Participants may also use

their non-productive incomes to purchase maximum shares in their VSLAs so that they can take a

larger loan for their enterprises and/or for substantial expense. These substantial expenses are

mostly non-productive and may include furniture and appliances.

5.Discussion

The difficulty for the researchers to understand the effects of VSLAs in terms of what members use

their drawings for is noted. It is even more difficult to measure productivity and incomes of

smallholder farmers because of two main factors. Firstly, researchers have to understand and

quantify the overall welfare effects of VSLAs. Generally, VSLA users spent bulk of their drawings on

consumption smoothing. Secondly, farmers struggle track incomes from their seasonal yields. In

most cases, smallholder farmers do not record yields they do not sell but consume. The findings of

the study tend to reveal the multifaceted benefits of VSLAsby exploring the extent participants use

their drawings for productive purposes.

Assets and capabilities of the participants to diversify their sources of income were observed.

Productive assets included broiler cages, egg layer cages, fenced gardens, cattle and goat kraals,

plastic water tanks, protected and piped water springs, tunnels, tuck-shops and farming implements.

Other non-productive resources that manifest improved quality of life and livelihoods included

brick/block houses, furniture like sofas, television sets, satellite television connection, appliances like

11

refrigerators and microwaves. The SLF describes the combined use of resources and productive

assets as livelihood strategies that are employed to prevent or mitigate specific risks and to achieve

the desired livelihood outcomes (Knutsson & Ostwald, 2006).

Years living in the same community, understanding of local market trends and years of farming

experience had a positive significance with FLG members’ participation in VSLAs. This is because

VSLA members may have few years to sort out consumption pressures that directly compete with

early stages of enterprise development. The implication is that extended participation in VSLAs have

a positive impact on the participants with regards household welfare pressures. However, such

conclusions need further interrogation. It is therefore recommended that future studies examine

whether participants with a longer history of participation in VSLA are likely to invest more in their

enterprises.

Short duration of loans remain a serious concern for FLG operating business enterprises since loan

terms constrain extended investments in enterprises. Generally, many NGOs promote annual saving

cycles for a number of reasons. One of the reasons is that VSLAs build on practices of non-VSLA

schemes in communities are established to guard against risks and meeting life-cycle events hence

the need for multiple income streams (Rutherford, 2000). Financing farming operations with VSLA

drawings (short-term loans and lump sum share-outs) is a very complicated affair because loans are

usually serviced by incomes received from non-farming enterprises. In some cases, VSLA loans may

not be aligned to production. As mentioned earlier, the loan fund may not be sufficient for all

farmers to borrow in a given planting season. This provides an opportunity for NGOs to investigate

options that would see VSLAs bulking loans and provision extended loan repayment periods. This

means NGOs investing time and resources to explain the benefits of bulking of loans, charging of

affordable annual interest, and extending saving cycles to three years of more. It also means

promoting diversification into trading activities in order to increase earnings and to enable

borrowers to service VSLA loans while waiting for harvesting, eggs to be laid or broilers to be sold.

However, diversification into trading activities may risk shifting farmers’ concentration from

production activities and consequently drop the farm yields.

6.Conclusion

In conclusion, the use of SLF for this study to understand the extent participants use drawings from

their VSLAs to operate their businesses reinforced the claim that SLF can be used as a framework for

facilitating planning of new development interventions (Morse & McNamara, 2013). The study was

able to draw from the capabilities of farmers in terms of assets they accumulate as a results of

improved access to financial services from their VSLAs. As a result participants were found able to

improve their capabilities, accumulate capital and assets, and provide better livelihoods for their

families (Chambers & Conway, 1992). The study has demonstrated that identification of resources

and assets that FLG members accumulate during the course of their participation in their VSLAs gives

a better understanding how incomes are recycled and used.

12

References

Allen, H., & Staehle, M. (2007). VSLA programme guide: Field operations manual. VSL Associates.

Allen, H. (2002). CARE International’s village savings & loan programmes in Africa. Tanzania CARE.

Allen, H., & Panetta, D. (2010). Savings Groups: What Are They? Washington, DC: The SEEP Network.

Allison, E. H., & Horemans, B. (2006). Putting the principles of the sustainable livelihoods approach

into fisheries development policy and practice. Elsevier. 30(6), 757-756.

African Response Research (2012) ‘Stokvels -A hidden economy’, African Response Research, (May

2012), pp. 1–19.

Arko-achemfuor, A. (2012) ‘Financing Small, Medium and Micro-Enterprises (SMMEs) in Rural South

Africa: An Exploratory Study of Stokvels in the Nailed Local Municipality, North West

Province’, Journal of Sociology Soc Anth, 3(2), pp. 127–133.

Bateman, M. (2010). Why doesn’t microfinance work? The destructive rise of local neoliberalism. Zed

Books.

Baumann, P. (2000). Sustainable livelihoods and political capital: Arguments and evidence from

decentralisation and natural resource management in India. London: Overseas Development

Institute

Banerjee, S. B., & Jackson, L. (2016). Microfinance and the business of capacity reduction. Critical

perspectives from rural Bangladesh. Human Relations. 70(1), 63-91.

CARE. (2017). VSLA Global outreach report. An overview of the global reach of CARE's village savings

and loans association programming. Toronto: CARE.

Carney, D., Drinkwater, M., Rusinow, T., Neefjes, K., Samir, W., & Singh, N. (1999). Livelihood

approaches compared: A brief comparison of the livelihood approaches of the UK. London:

DFID.

Chambers, R. & Conway, G. R. (1992). Sustainable rural livelihoods: practical concepts for the 21st

century. IDS Discussion Paper, January, pp. 1-29.

Dercon, S. (2001). Assessing Vulnerability. Jesus College and CSAE, Department of Economics, Oxford

University

DFID. (1999). Sustainable Livelihoods Guidance Sheets. London: Department for International

Development.

Dichter, T., & Harper, M. (2007). What’s wrong with microfinance? Practical Action Publishing.

13

Duranti, A. (2011). Linguistic anthropology: The study of language as a non-neutral medium. In R.

Mesthrie (Ed.), The Cambridge handbook of sociolinguistics, (pp. 28-46). Cambridge

University Press.

Duvendack M., Palmer-Jones R., Copestake J., Hooper L., Loke Y., & Rao N. (2011). What is the

evidence of the impact of microfinance on the well-being of poor people?Social Science

Research Unit, Institute of Education, University of London.

Krantz, L. (2001). The sustainable approach to poverty reduction. Stockholm: SIDA.

Kollmair, M., & Gamper, S. (2002). Sustainable livelihood approach. Input paper for the integrated

training course for NCCR North South. Development study group. Zurich: University of

Zurich.

IFAD (2019). Annual report.

https://www.ifad.org/documents/38714170/41784870/AR2019+EN.pdf/ba495c3d-7db8-

a688-08d2-1589ade15f4f

Knutsson, P. & Ostwald, M. (2006). A process-orientated sustainable livelihoods approach - A tool for

increased understanding of vulnerability, adaptation and resilience. Mitigation and

adaptation strategies for global change

Mader, P. (2015). The political economy of microfinance: Financialising poverty. Palgrave.

Morse, S. & McNamara, N. (2013). The theory behind the sustainable livelihood approach -

sustainable livelihood approach: A critique of theory and practice

Markel, E., & Panetta, D. (2014). Youth savings groups, entrepreneurship and employment.

Retrieved from London

Morse, S., MaNamara, N., & Acholo, M. (2009). Sustainable livelihoods approach: A critical analysis

of theory and practice. Geographical paper 189. Reading: University Reading.

Neergaard, H., & Leitch, C.M. (2015). Handbook of qualitative research techniques and analysis in

entrepreneurship. Edward Elgar

Ngcobo, L. (2019). The dynamics of education and stokvels in South Africa. Acta Univ. Danubius.

Scoones, I. (1993). Analysing policy of sustainable livelihoods. London: Institute for Development

Studies.

Makuwira, J. (2006). Development? Freedom? Whose Development and Freedom? Development in

Practice, 16(2), 193–200. http://www.jstor.org/stable/4029879

14

Nxumalo, K.K.S., & Oladele, O.L. (2013). Factors affecting farmers participation in agricultural

programme in Zuland district, KwaZulu- Natal province, South Africa

Rengasamy, S. (2009). Introduction to livelihood approach. Timal Nado: Madurai Institute of social

sciences

World Bank. (1996). World Development Report: Poverty, New York: Oxford University Press.