1

Matatiele Livelihoods Assessment

September 2014:Emerging data

Brief overview of outcomes

Savings and Credit Groups (SCGs) are key within the SaveAct model in assisting the rural poor and specifically

women to engage actively in productive activities such as agricultural enterprises. The commodity interest group

(CIG) focus for agricultural enterprises assists substantially in providing cheaper inputs, improving production and

gaining knowledge for their enterprises. In interviews conducted with participants, of a sample of 100 , all CIG

participants have mentioned trying out new ideas introduced in the CIG meetings and learning workshops. Around

48% of CIG participants have made use of the bulk buying processes set up.

Currently, there is a growing demand for production training in poultry and vegetables, training and support in

rainwater harvesting, and Isiqalo (business start up) training. Further support in bulk buying and access to inputs has

been requested.

Most of the SCG and CIG participants are women, the majority of whom are older women. Their overall average

incomes are extremely low at around R1 800/month. People spend around 15% of their incomes on their

agricultural enterprises, using primarily SCG loans and share-outs for these activities. Basic needs, home

improvements, education and consumption smoothing

1

take up the largest proportion of their expenditure.

Of the 85% of respondents in a survey of CIG participants involved in agricultural enterprises close to 50% do not

make an income from these activities, but produce food for their households.

Introduction and background

SaveAct has been operating in Matatiele for around five years. In this time the SCGs have expanded dramatically and

support has been provided for local economic development.

A PMSA (participatory market system analysis) was done for the Matatiele, Mt Fletcher area towards the end of

2010. The process led to the development of the agricultural enterprise support model which includes a VCA

(participatory value chain assessment) for interested SCG members in a locality, the creation of CIGs (Commodity

Interest Groups) around locally prioritized commodities/ agricultural enterprises, training in business start-up skills

(Isiqalo) for interested CIG members and ongoing mentoring support in input supply, production aspects and

marketing within the CIGs.

In 2013 more coherent support for Isiqalo training and CIGs was provided. The table below summarises the

participation in these processes.

Isiqalo training summary; Matatiele 2013

No

Isiqalo trainee days

102

Improvement of current business (according to business plans submitted)

40 (n=69)

New businesses (Acc to new business plans submitted)

16 (n=69)

Isiqalo themes per training group:

Poultry; broiler production

1

Sheep; meat and wool

1

Vegetable production and sheep management

1

1

Consumption smoothing relates to a person’s abilities to cover their monthly expenses and basic needs such as food, shelter, health,

educational and cultural needs and the like and also to reducing indebtedness

2

Vegetable production and poultry

2

CIG training summary; Matatiele 2013

No

Total CIG trainee days (overall no of people attending)

548

Total number of CIG training days

35

Average number of participants per training day

16

CIG theme:

Maize

94

Poultry

58

Sheep

50

Pigs

67

Vegetables

27

Bulk buying has been a strong focus of the CIGs and since 2011 has included; potato seed, vegetable seedlings and

more recently, poultry ‘packs’. Isiqalo training has been conducted for around 200 individuals over the past 3 years.

A focused programme around smallholder farmer innovation in maize and bean production, working with

conservation agriculture (CA) principles and techniques has been initiated in partnership with GrainSA and the Maize

Trust.

In July 2014 research was initiated to assess the livelihoods of participants, including changes and potential impact of

the agricultural enterprise interventions. This research was designed partly as a preliminary attempt to develop an

appropriate methodology for a livelihoods tracking system, and partly to achieve a better understanding of the

livelihood outcomes and impact associated with SaveAct’s work.

An E-survey consisting of 70 questions and including photographs of respondents’ homesteads and enterprise

activities as well as GPS coordinates was conducted using the Dooblo software and online platform. 5 Post graduate

students, working with tablets, assisted in the interviewing process

One hundred respondents (89% female) from 13 different villages and representing 54 SCGs, were interviewed.

Total supervised membership at present is 4195 members across 227 SCGs (7726 members in total across 418

SCGs). This sample size provides a confidence interval of 5.86% at a 95% confidence level. Random selection at SCG

and CIG meetings was used as a sampling procedure. This falls within purposive sampling methodology, which is a

non parametric approach.

See Table 1 below for a breakdown of respondents’ villages, SCG and CIG membership and CA participation. All

respondents are members of SCGs formed by SaveAct. 85% of respondents considered themselves members of

CIGs or had some CIG involvement and 10% of respondents were part of the CA farmer innovation programme (of

a total of 24 participants there).

TABLE 1:RESPONDENTS INTERVIEWED IN THE LIVELIHOODS ASSESSMENT

No of respondents per village

CIG member

CA participant

Village name

Female

Male

Total

Hebron

4

3

7

6

Khauoe

20

1

21

14

3

Khutsong

1

2

3

3

Lubisini

16

16

15

2

Pontsheng

16

1

17

16

5

Stathi

5

5

4

Thinana

3

3

3

Other

24

4

28

24

Andries Location

1

1

1

Jabulani

5

2

7

7

Maluti

9

9

6

3

Mapeng

3

2

5

5

Pehong

5

5

4

St. Paul

1

1

1

Total

89

11

100

85

10

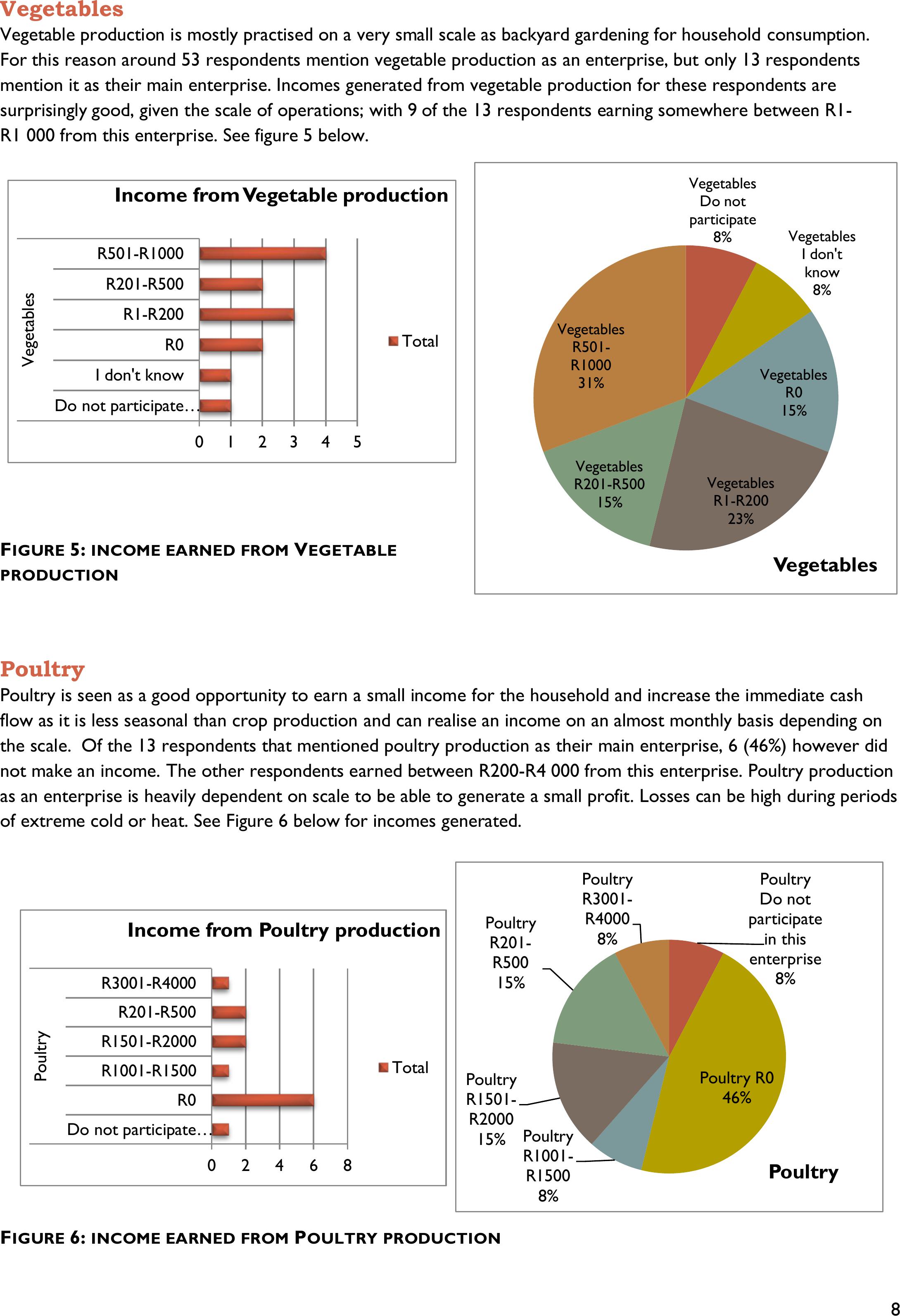

Information collected regarding the date of birth of the respondents suggests a predictable trend towards older

women being involved in SCGs and agricultural enterprises. This follows the overall trend in rural areas of women

being primarily responsible for providing food for their families, while younger women do not engage as prominently

in farming activities. Thus, only 5% of respondents are younger than 30 yrs and 58% of respondents are older than

60 years of age. Including CIG membership into the table of age distribution shows a curious trend where women

between the ages of 50-60 years are the least involved in CIGs, and the younger and older age groups show around

80% representation.

TABLE 2:AGE OF RESPONDENTSLINKED TOCIGMEMBERSHIP

Age range in years

No of respondents

No of CIG members

Unknown

2

1

21-30

5

5

31-40

10

8

41-50

25

17

51-60

25

21

61-70

26

25

71-80

6

5

≥ 81

1

1

Sources of income of respondents

Respondents were asked about their sources of income. It is known that social grants are relatively ubiquitous in

rural areas and that more and more people rely mainly or solely on these grants to survive. A few questions were

therefore focussed on the contribution of social grants to respondents’ overall incomes

87 out of 100 Respondents mentioned receiving social grants. Moreover, 20 respondents had at least two types of

grant (usually pension and child grants) and 3 respondents had all three types of grant(including a disability grant).

See table 3 below for a breakdown of the various grants received.

TABLE 3:SOCIAL GRANTS RECEIVED BY RESPONDENTS: BREAKDOWN OFSOCIAL GRANTS ACCORDING

TO GENDER.

Respondents were subsequently asked about their main source of income. 68% of Respondents consider grants as

their main source of income, 18% are employed, and 6% run their own enterprises. For the women, remittances still

The type of grant.

No of respondents

Female

79

Child grants

41

Disability grants

3

Pension

35

Male

8

Child grants

3

Pension

5

Total

87

4

play a role and 7% receive these as their main source of income. Table 4 below compares the main source of

income with the average monthly income as set out by respondents.

For those with social grants as their main source of income, around 19% receive R501-R1 000, 51% receive between

R1001-R2 000/month and 20,5% receive between R2001-R3 000.

TABLE 4:MAIN SOURCE OF INCOME OF RESPONDENTS,INDICATING INCOMES EARNEDACCORDING TO

GENDER

Main source of income

for your household

>R6 000

Don't

know

R1001-

R2000

R1-R500

R2 001-

R3000

R3001-

R4000

R4001-

R6000

R501-

R1000

Total

Female

2

1

42

4

18

4

1

17

89

Employment

1

1

8

3

1

1

2

17

Own enterprise

2

1

1

4

Remittances

1

2

1

1

2

7

Social Grants

30

4

13

1

13

61

Male

1

2

5

1

1

1

11

Employment

1

1

Other

1

1

Own enterprise

1

1

2

Social Grants

1

5

1

7

Total

3

3

47

4

19

4

2

18

100

CIGS (%)

2

2

55

5

17

4

1

14

100

A visual representation of the above table is found in Figure 1 below. It indicates that income potential is generally

similar for people whether they get their income from grants, own enterprises, remittances or employment. Income

averages for most people between R1 001-R2 000 per month.

The sample distribution is as follows:

Income range

No of respondents (N=97)

%

R1-R1000

22/97

23%

R1001-R2000

47/97

48%

R2 001- R3 000

19/97

20%

R3 001-R4 000

4/97

4%

>R 4 000

5/97

5%

0

5

10

15

20

25

30

35

40

Employment

Other

Own enterprise activity

Remittances

Social Grants

5

FIGURE 1:DISTRIBUTION OF INCOMEEARNED RELATED TO INCOME SOURCES.

Figure 2 below gives an indication of the breakdown of income categories for those respondents belonging to

commodity interest groups (CIGs). All income groups are well represented, with a slightly higher representation of

the lower income groups in the CIGs. 74% earn between R1-R2 000 compared to 69% in the overall group.

FIGURE 2:DISTRIBUTION OF INCOMEEARNED RELATED TO CIG MEMBERSHIP

Agricultural Enterprises

Respondents were asked which enterprises they are involved in, in order of their importance. This will differ for

each individual, but does give a broad indication of involvement in agricultural enterprises for all respondents. This

shows that around 41% of respondents are involved in potato production, 16% in maize production and 13% in

poultry and vegetable production respectively.

TABLE 5:INVOLVEMENT IN AGRICULTURALENTERPRISES

Agricultural

enterprise

CIG member;

Main enterprise

Non

member

Total

Single

enterprise

Multiple enterprises

and CIG members

Maize

16

16

1

47

None

1

14

15

15

Potato

40

1

41

3

41

Poultry

13

13

11

42

Sheep

2

2

2

12

Vegetables

13

13

8

53

Pigs

-

-

-

-

15

Total

85

15

100

25

Most respondents are involved in a number of different agricultural enterprises; mostly between 2 and 4. This is

shown in the small synopsis table above. Those involved in only one agricultural enterprise are proportionally few

(25 of 85 CIG members) compared to those involved in 2 or more enterprises (70% of respondents).

>R6 000

2%

Don't know

2%

R1001-R2000

55%

R1-R500

5%

R2 001-R3000

17%

R3001-R4000

4%

R4001-R6000

1% R501-R1000

14%

6

Table 6 below gives an indication of the combination of enterprises respondents are involved in. It has been

constructed for a series of 3 enterprises to illustrate the trend. If one looks for example at those respondents that

grow maize, 1 of the 16 respondents grows maize only, 8 simultaneously keep poultry, 8 also grow vegetables, 3 also

keep sheep, 2 have pigs and 1 has cattle.

TABLE 6:COMBINATION OF AGRICULTURAL ENTERPRISES

Enterprise1

Enterprise 2

Enterprise 3

Total

Maize

1

Maize

Poultry

3

Maize

Poultry

Pigs

2

Maize

Poultry

Sheep

1

Maize

Vegetables

4

Maize

Vegetables

Cattle

1

Maize

Vegetables

Poultry

2

Maize

Vegetables

Sheep

2

Sub-Total

16

Potato

Maize

1

Potato

Maize

Poultry

1

Potato

Maize

Vegetables

29

31

Total Maize producers

47

This analysis indicates that most participants engage in a number of different agricultural activities/enterprises and

that each person prioritises their enterprises within their own household and economic context. Most participants

do have a ‘main’ enterprise or activity that they focus on.

CIG Membership

Potatoes

Table 7 below indicates that the CIGs for potatoes were started in 2010. In 2011 very few people joined. A steady

increase was shown in 2012 and 2013.

Similar trends are apparent for all the CIGs, mostly because in 2011, very little focus was given to this work. For

2012 and 2013 a steady increase in membership is shown.

TABLE 7:POTATO CIG MEMBERSHIP ACROSSVILLAGES

Year of

joining

Hebron

Khauoe

Khutsong

Lubisini

Other

Pontsheng

Stathi

Total

2010

1

2

1

3

5

12

2011

2

2

1

5

2012

2

5

3

1

11

2013

1

2

1

4

2

3

13

2014

1

1

Total

3

8

2

4

12

12

1

42

Respondents were asked about the incomes they have earned from each of their agricultural enterprises, including

potato production. Incomes have been summarised for the main enterprise mentioned by respondents. The two

figures below indicate the incomes generated from potato production.

41 Respondents participated in potato production. Of these 23 did not earn an income from their production (56%).

Thismeans that the harvest was used for household consumption. 15 Respondents (30%) earned between R1-

7

R1 000. A small percentage of respondents earned a reasonably substantial income of more than R2 000 and in one

case around R8 000 form their potato production.

FIGURE 3: INCOME EARNED FROM POTATO PRODUCTION .

Maize

Maize is produced mainly for household consumption and also in quite small plots of land as people now are using

primarily their homesteads lots for production and not the larger fields generally situated much further away from

the homesteads. Two respondents made an income of between R501-R1 000 and one respondent made an income

of R1 001-R1 500.

FIGURE 4: INCOME EARNED FROM MAIZE PRODUCTION

Potato

member I

don't

know

3%

Potato

member

R0

56%

Potato

member

R1501-

R2000

5%

Potato

member

R1-R200

10%

Potato

member

R2001-

R2500

2%

Potato

member

R201-R500

15%

Potato

member

R501-

R1000

5%

Potato

member

R8 001-

R10 000

2%

Potato non

member

R0

2%

Potatoes

0510 15 20 25

Potato member I don't know

Potato member R0

Potato member R1501-R2000

Potato member R1-R200

Potato member R2001-R2500

Potato member R201-R500

Potato member R501-R1000

Potato member R8 001-R10 000

Potato non member R0

Income from potato production

Total

0510 15

R0

R501-R1000

Maize

Income from maize

production

Total

Maize R0

81%

Maize

R1001-

R1500

6%

Maize

R501-

R1000

13%

Maize

8

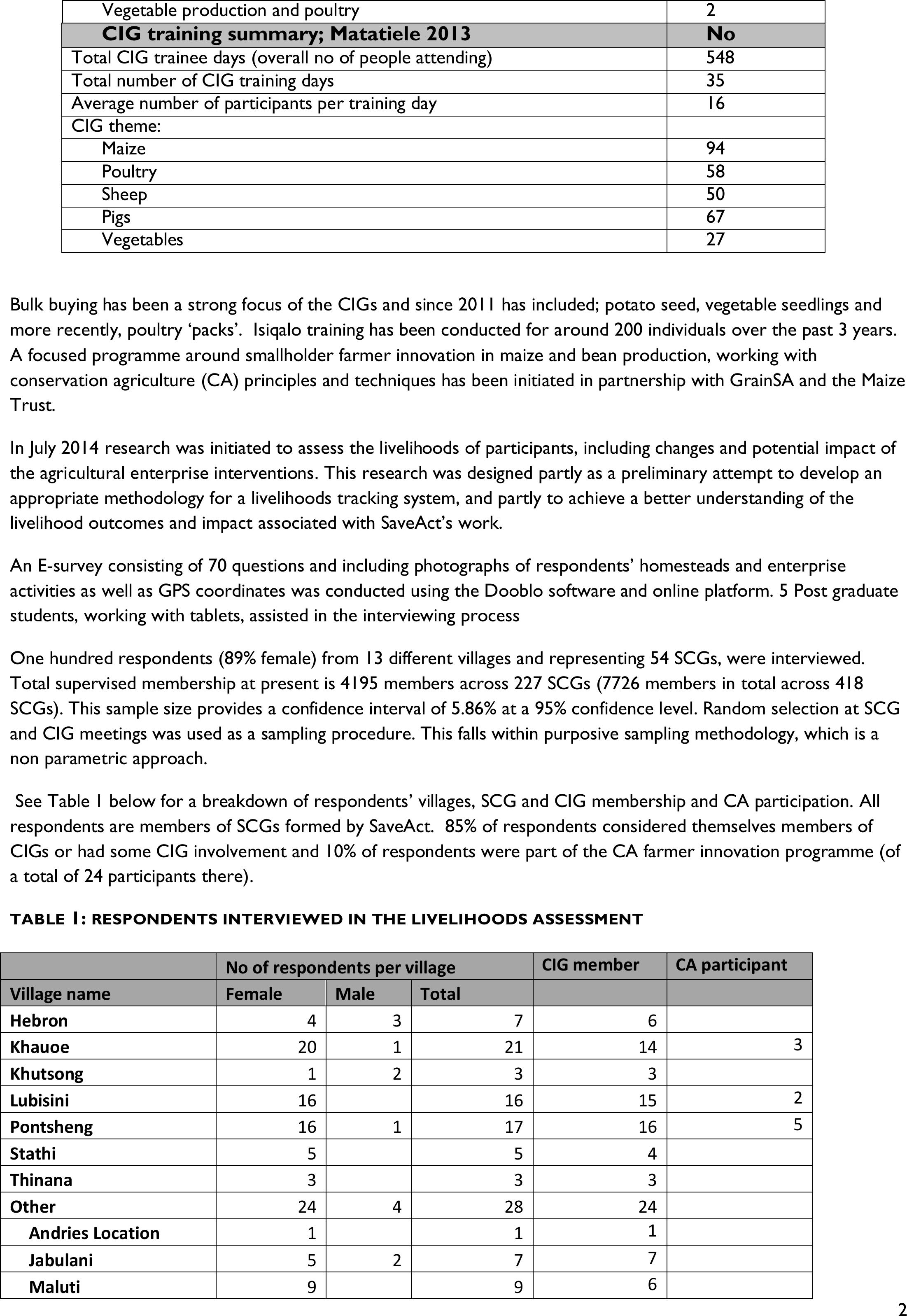

Vegetables

Vegetable production is mostly practised on a very small scale as backyard gardening for household consumption.

For this reason around 53 respondents mention vegetable production as an enterprise, but only 13 respondents

mention it as their main enterprise. Incomes generated from vegetable production for these respondents are

surprisingly good, given the scale of operations; with 9 of the 13 respondents earning somewhere between R1-

R1 000 from this enterprise. See figure 5 below.

FIGURE 5: INCOME EARNED FROM VEGETABLE

PRODUCTION

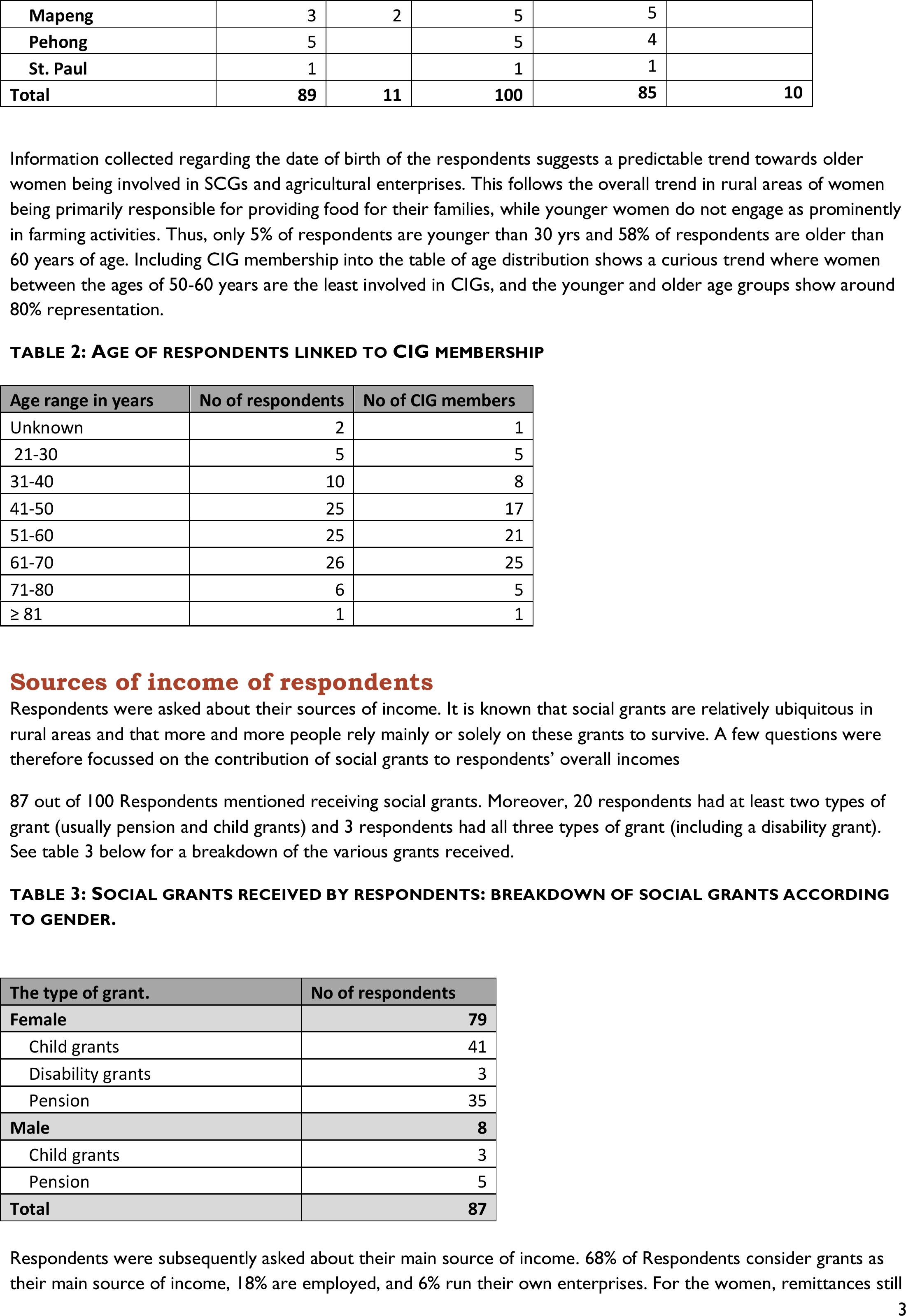

Poultry

Poultry is seen as a good opportunity to earn a small income for the household and increase the immediate cash

flow as it is less seasonal than crop production and can realise an income on an almost monthly basis depending on

the scale. Of the 13 respondents that mentioned poultry production as their main enterprise, 6 (46%) however did

not make an income. The other respondents earned between R200-R4 000 from this enterprise. Poultry production

as an enterprise is heavily dependent on scale to be able to generate a small profit. Losses can be high during periods

of extreme cold or heat. See Figure 6 below for incomes generated.

FIGURE 6: INCOME EARNED FROM POULTRYPRODUCTION

0 1 2 3 4 5

Do not participate…

I don't know

R0

R1-R200

R201-R500

R501-R1000

Vegetables

Income from Vegetable production

Total

Vegetables

Do not

participate

8% Vegetables

I don't

know

8%

Vegetables

R0

15%

Vegetables

R1-R200

23%

Vegetables

R201-R500

15%

Vegetables

R501-

R1000

31%

Vegetables

02468

Do not participate…

R0

R1001-R1500

R1501-R2000

R201-R500

R3001-R4000

Poultry

Income from Poultry production

Total

Poultry

Do not

participate

in this

enterprise

8%

Poultry R0

46%

Poultry

R1001-

R1500

8%

Poultry

R1501-

R2000

15%

Poultry

R201-

R500

15%

Poultry

R3001-

R4000

8%

Poultry

9

For sheep production, there were only two respondents who mentioned this as their main enterprise. One

respondent did not make an income and the other made an income of between R501-R1 000.

Use of small loans from SCGs for agricultural enterprises

Saving and Credit group (SCG) members take out small loans on a monthly or bi monthly basis, in their groups.

These loans can not be more than double their present savings in the group and are agreed to unanimously by the

whole group prior to being awarded. Interest of ≤ 10% is charged on these small loans and they are apdi pack on a

regular basis within the saving cycle of 12 months. At the end of the yearly saving cycle people receive thier shar

out- which is a combination of their savings ofr hte year and a proportion of the interest earned by the group from

small laons.

Particpants use the small loans for a number of different purposes, including thier agricultural and other small

enterprises.

Most respondents (78%) took between 1 and 3 small loans in their previous savings cycle in their SCGs. See Table 8

below.

TABLE 8:NUMBER OF SMALL LOANS TAKEN BY RESPONDENTS IN THEIR PREVIOUS SAVINGS CYCLE

No of loans during the PREVIOUS cycle

CIG member

Non member

Total

1

16

4

20

2

26

6

32

3

26

26

4

2

2

5

2

1

3

6

2

2

More than 8

1

1

None

10

4

14

Total

85

15

100

Table 9 below indicates the frequency of expenditure type per loan. Around 21% of the small loans taken in the

previous savings cycle (2013) were taken for agricultural enterprises, 27% for basic needs and house improvements

respectively, 14% for education and only 3% for non agricultural enterprises. Other categories for which small loans

were taken include starting enterprises and paying off debts, as well as traditional ceremonies, paying off vehicles,

buying a water tank, etc.

TABLE 9:FREQUENCY OF EXPENDITURE TYPE PERLOAN

Frequency of Expenditure Type Per Loan

Agric

Enterprise

Basic

Needs

Education

House

Improvements

Non-

agricultural

enterprise

Other:

start

enterprise

Other:

Pay off

debt

Other

Total

Loan 1

17

15

14

16

3

2

2

6

75

Loan 2

16

17

10

32

2

0

0

3

80

Loan 3

7

13

5

6

1

0

0

2

34

Loan 4

1

6

0

1

0

0

0

1

9

Loan 5

1

4

0

1

0

0

0

0

6

10

Sub total

42

55

29

56

6

2

2

12

204

%

21%

27%

14%

27%

3%

1%

1%

6%

A visual representation of the information in the above table is shown below.

FIGURE 7:USE OF SMALL LOANS IN SCGS FOR DIFFERENT ACTIVITIES

Looking at the amounts spent on small loans for the main activities, those taken for house improvements are the

largest and most common with 25% of the loans being between R3 001-R5 500 and the other 75% being below

R2 000. This is followed by agriculture where 76% of the small loans are below R2 000 for the year, 185 are

between R2 501-R3 000 and 6% are above R3 000. The small loans for basic needs are predictably smaller with 87%

of the small loans being less than R2 000 for the year.

TABLE 10:AVERAGE SIZE OF SMALL LOANS TAKEN BY RESPONDENTS IN THE PREVIOUSSAVINGS CYCLE

(2013)

Size of small loans

Agric Entrprises

Basic Needs

House

improvements

Education

R1-R500

4(27%)

1

R501-R1 000

5(29%)

5(33,5%)

12(37,5%)

4

R1 500- R2 000

8(47%)

4(27%)

12 (37,5%)

3

R2 500-R3 000

3(18%)

2(13,5%)

3

R3 001-R5 500

1(6%)

8(25%)

4

17

15

32

15

19,7%

17,4%

37,2%

17,4%

Considering the overall amounts of the loans taken a similar percentage as the number of loans comes to the fore,

with around 21,5% of the overall loans of R372 403 for agricultural enterprises (R80 100). For home improvements

the amount taken for loans (R108 825) is 29,2% of the overall amount and that for basic needs was 22,1% of the

overall total. See table 11 below.

TABLE11:RAND VALUE OF SMALL LOANS FOR DIFFERENT ACTIVITIES COMPARED TO THE TOTAL

AMOUNT

Agric ent

Basic needs

Education

House improve

Non-agric ent

Other

Grand

Total

Loan 1

32400

19500

29330

61800

3500

12500

159030

0

5

10

15

20

25

30

35

Loan 1

Loan 2

Loan 3

Loan 4

Loan 5

11

Loan 2

31700

25700

22500

33500

4100

12000

129500

Loan 3

13700

24300

13000

11025

800

3500

66259

Loan 4

800

8200

1000

9908

Loan 5

1500

4800

1500

7706

Total

R80100

R82500

R64830

R108 825

R8 400

R28000

R372 403

Total Agricultural Enterprise

Loans in Previous Cycle – 2013

21,5%

Total House improvements

Loans in Previous Cycle – 2013

29,2%

Total Basic Needs Loans in

Previous Cycle – 2013

22,1%

Total Education in Previous

Cycle – 2013

17,4%

Use of share-outs for agricultural enterprises

Share-out amounts for the last saving cycle (2013) ranged from R801-R21 000 for the 100 respondents. The

average amount for the respondents was R4 344, with the largest number of respondents, 17% receiving

between R2 001-R3000. 56% of respondents used some of their share-out money for their enterprises,

with a larger proportion of CIG members (58%) using share-out monies for their enterprises than non-CIG

members (47%).

TABLE12:USE OF SHARE-OUTS FROM SCGS FOR ENTERPRISES OFCIGAND NONCIG MEMBERS

RESPECTIVELY

Use some of your share-out money from the

previous cycle for your enterprise?

No

Yes

Total

CIG member

36

(58%) 49

85

non member

8

(47%) 7

15

Total

44

56

100

Of those that used share-out money towards agricultural enterprise, 49% spent between R1-R500. 32,5% used

between R501-R1000 and 7,5% used more than R1000. See Figure 8 below.

FIGURE 8:AMOUNT OF PREVIOUS CYCLE (2103)SHARE-OUTS SPENT ON AGRICULTURAL ENTERPRISES

(N=100)

I don't

know R 0

R1001

-

R1500

R1-

R200

R201-

R500

R3001

-

R4000

R501-

R1000

member 2 43 1 1410 2 13

non member15

0

10

20

30

40

50

No of respondents

Amount of previous share out spent on

agricultural enterprises

12

Use of other financial resources for agricultural enterprises

Respondents were also asked about their use of financial resources outside of their SCGs for agricultural

enterprises. Rural people often have a wide variety of income sourcesoutside of their ‘Main incomes’ (day labour,

some remittances even if not regular, small incomes from sales. etc) and this question is an attempt to get an

indication of the contribution of these other financial resources both to their overall income and to their agricultural

enterprises.

The table below indicates the amounts spent by respondents from other resources related to their expressed

average monthly income. The amounts spent from other financial resources is a yearly amount and thus incomes

have been expressed as yearly amounts for the purposes of this table.

TABLE13:RESPONDENTS’USE OF OTHER FINANCIAL RESOURCES FORTHEIR AGRICULTURAL

ENTERPRISES, RELATED TO THEIR AVERAGE YEARLY INCOME

Expenditure on Agric Enterprises

from Other Financial Resources

Employment

Other

Own

enterprise

activity

Remittances

Social

Grants

Grand

Total

>R72000

2

1

3

No other financial resources

1

1

2

R201-R500

1

1

Don't know

1

1

1

3

More than R2 000

1

1

No other financial resources

1

1

R1-R200

1

1

R12 001-R24 000

8

2

2

35

47

More than R2 000

2

2

No other financial resources

5

1

13

19

R1-R200

2

15

17

R201-R500

1

4

5

R501-R1 000

1

1

1

1

4

R1200-R 6 000

4

4

No other financial resources

1

1

R1-R200

1

1

R201-R500

2

2

R24 001-R36 000

3

1

1

14

19

No other financial resources

2

8

10

R1-R200

1

1

3

5

R201-R500

2

2

R501-R1 000

1

1

2

R36 001-R48 000

1

1

1

1

4

No other financial resources

1

1

2

R1 001-R2 000

1

1

R1-R200

1

1

R48 001-R72 000

1

1

2

No other financial resources

1

1

2

R6 001-R12 000

2

1

2

13

18

No other financial resources

1

2

7

10

R1 001-R2 000

1

1

R1-R200

1

4

5

R201-R500

1

1

13

Expenditure on Agric Enterprises

from Other Financial Resources

Employment

Other

Own

enterprise

activity

Remittances

Social

Grants

Grand

Total

R501-R1 000

1

1

Total

18

1

6

7

68

100

The table above can be conveniently summarised asfollows.

TABLE14:SUMMARYOF AVERAGE YEARLY INCOMES RELATED TO OTHER FINANCIAL RESOURCESUSED

FOR AGRICULTURAL ENTERPRISES IN MATATIELE

Avg yearly

income→

Other financial

resrouces↓

R1-R12

0000

(N=22)

R12 001-

R24000

(N=47)

R 24001-

R36 000(N=19)

R36000 –

R48

000(N=4)

>R48 001

(N=5)

% of overall

respondents

(N=97)

None

11/22 (50%)

19/47 (40%)

10/19 (53%)

2/4 (50%)

4/5 (80%)

47%

R1-R1000

10/22 (45%)

26/47 (55%)

9/19 (47%)

1/4(25%)

1/5 (20%)

48%

R1001-R2 000

1/22 (5%)

1/47 (2%)

1/4 (25%)

3%

>R2 000

2/47 (3%)

2%

This table indicates that around 53% of the respondents use other resources outside of their SCGs and main

incomes for their agricultural enterprises, across the five different ranges of income. Of these the largest proportion

(48%) use between R1-R1 000 per year.

The use of small loans and share-outs in SCGs was then linked to the use of other financial resources to get an

indication of overall expenditure by respondents on their agricultural enterprises. Respondents from all five of the

income groups mentioned above took loans of similar sizes. There was no trend for smaller loans, or fewer for that

matter, for respondents in the lower income groups, as might have been expected. From Table 15 below it can be

seen that 47% of respondents use only SCG loans for their agricultural enterprises and no other financial resources.

74% of the respondents who take SCG loans use between R1-R2 000 per year, 16% use between R2 001-R3000/

year and 10% use more than R3 000.

TABLE15:SUMMARY OF SCG LOANSUSED FOR AGRICULTURAL ENTERPRISES IN MATATIELE

Value of small loans taken – across all income

groups

Overall percentage of respondents

R1-R1 000

38%

R1 001-R2 000

36%

R2 001-R3 000

16%

R3 001-R4 000

7%

>R4 000

3%

Adding all the finances used for agricultural enterprises together the following averages can be calculated:

TABLE16:SUMMARYOF ALL EXPENDITURE RELATED TO AGRICULTURAL ENTERPRISES LINKED TO

AVERAGE YEARLY INCOME IN MATATIELE.

Financial source for Agricultural enterprises

Average in Rands

14

SCG loans (2013)

R1 500

Money from share out (2013)

R 750

Other financial resoruces

R1 000

Total average

R3250

Average monthly income

R1800

Average yearly income

R21 600

% of income spent on agricultural enterprises

15%

This means that people take out the same size loans even if their incomes are higher. This potentially relates to the

structure of the SCG and how shares are bought and loans provided. Overall participants spend an average of 15%

of their incomes on agricultural enterprises, across the five income groups specified.

Involvement in CIGs

Respondents were asked what activities they have been involved in through their CIGs. Mostly they mentioned the

learning sessions and meetings as shown in the small table below.

TABLE17:SPREAD OF CIGPARTICIPANTS ACROSS ACTIVITIES

Activities in CIGs

Implementation

1

Learning sessions

42

Marketing

1

Meetings

56

Total

100

They were also asked to describe new activities they have been involved in through their involvement with SaveAct

and with the CIGs. Here the research shows that respondents have tried out new ideas in their agricultural

enterprises through their meetings and learning sessions.

FIGURE 9NEW ACTIVITIES UNDERTAKEN THROUGH CIGSIN MATATIELE (N=40)

None

Savings

and

credit

Maize and

bean

productio

n:

Conserva

tion

Agricul…

Poultry

productio

n

Vegetable

productio

n

Potato

productio

n

Pig

productio

n

Sheep

productio

n

Disease

control in

cattle

Goats

Series1 2630198 6 3 3 1 1 1

0

5

10

15

20

25

30

35

No of people

New Activities involved in through CIGs

15

Participation in bulk buying

40 of the respondents interviewed participated in bulk buying. Respondents spent mostly between R1-R200 on bulk

buying, purchasing vegetable seedlings (19) and potato seed (13) through this system. Five respondents participated

in the poultry bulk buying process and three in buying breeding stock of sheep.

FIGURE 10:BULK BUYING ACTIVITIES INMATATIELE (N=40)

Improvement in business since involvement in CIGs

This question gives an indication of whether and how participants’ enterprises have improvedbecause of their

involvement in CIGs.29% of respondents felt that their inputs are now cheaper, 19% felt that production is better,

14% that they have gained knowledge and 5%felt that their incomes have improved. A small percentage have found

markets and have found inputs easier to access. 16% of respondents felt that their businesses have not improved.

FIGURE 11:BUSINESS IMPROVEMENT THROUGH INVOLVEMENT IN CIGS;MATATIELE (N=85)

R1-R200 R201-

R500

R501-

R1000

R1001-

R2000 >R2000

Seed Potato12 100

Vegetable Seedlings14 500

Poultry Package0 2 2 1

Breeding Stock02001

0

2

4

6

8

10

12

14

16

No of people

Bulk buying; Matatiele N=40

Has not

improved

16%

Income

improved

5%

Inputs

cheaper

29% Input

s

easier

to

acces

s

Knowledge

gained

14%

Markets

found

3%

Other

7%

Production

better

19%

Working

together

with

community

members

5%

Business improvement through

involvement in CIGs; Matatiele N=85

16

Present issues in enterprises and small business development

For the most part inputs are still the main problem for respondents, with 25% mentioning this as an issue.

Respondents wouldlike to be provided with inputs for free as part of projects. This was followed by the weather

(19%) and production factors (18%) such as poor soil fertility and lack of infrastructure. A small percentage of

respondents mentioned the need for markets (4%) and credit (3%).

18% of respondents mentioned that they have no issues and are satisfied with how their small businesses are going.

FIGURE 12:PRESENT BUSINESS ISSUES;MATATIELE (N=85)

Other issues mentioned consistently include a shortage of water, and pest problems on crops (such as cutworms

and moles). Issues such as diseases in chickens, animals eating crops, and lack of soil fertility were also mentioned, as

was the need for more information on goats and cattle. In terms of business related issues respondents mentioned

selling on credit and then running into trouble as people did not repay them, stock theft, late delivery of seedlings

and finding more people willing to be part of bulk buying activities.

Further support required/ requested

To get an indication of the most appropriate, needed and or desired interventions, respondents were asked what

further support they would need to effectively improve their agricultural enterprises. Table 18 below gives a

summary of their responses.

20% of respondents are satisfied with their present support. Most of the other respondents asked for more training

and information specifically in vegetable and poultry production. They also wanted training and support in water

harvesting and acquiringJo-Jo tanks (9%) and wanted to be provided with free agricultural inputs and infrastructure

(16%). There were also requests for easier access to day old chicks, herbicides and hand planters as well as support

for setting up bulk buying in their groups.

TABLE18:SUMMARYOF FURTHERSUPPORT REQUESTED BY RESPONDENTS IN MATATIELE.

Further support in:

No of responses

Satisfied with present support

20

Training and information in the following

Marketing and input supply

Poultry production

Vegetable production and pest control

Sheep rearing

Potato production

2

17

23

4

4

Credit

3%

Inputs

25%

Knowledge

1%

Market

4%

No issues

18%

Other

12%

Production

factors

18%

Weather

19%

Present business issues; Matatiele,N=85

17

Maize production

4

Water harvesting and Jo-Jo tanks

9

Agricultural support and inputs (free)

Fencing

Tractors

10

5

1

Easier access to

Day old chicks

Weed chemicals

Hand planters

3

4

2

Access to more credit

2

Follow up on enterprises

1

Bulk buying

5

Timely deliveries of seedlings

2

Isiqalo training

18 respondents receivedIsiqalo or business start-up training. 14 of the 18 filled in their business plans. Business plans

were filled in for the following commodities: maize (2) and vegetable production (7), poultry (6), sheep (2) and pigs

(1).

A question was also asked about the incomes respondents realised fromtheir enterprises. This was specifically for

respondents who received training and wrote out their business plans. There is no direct correlation between

respondents receiving Isiqalo training and doing theirbusiness plans, and them earning higher incomes from their

enterprises compared to other respondents participating in those enterprises. The range of incomes realised from

these small businesses are very similar to the incomes realised for all respondents involved in agricultural

enterprises.

More detailed follow up will need to be done on an individual basis to ascertain whether incomes and efficiency in

the small businesses have increased due to the training. Even then adirect correlation will be difficult due to other

factors that could have an impact, such as disease, weather, unfavourable market prices, etc.

FIGURE 13:ISIQALO TRAINING, BUSINESS PLANS AND INCOME FROM BUSINESS;MATATIELE (N=85)

-1 R 0R1001-

R1500

R1501-

R2000 R1-R200 R2501-

R3000

R501-

R1000

No Yes

Maize 1 1

Pigs 1

Poultry 2 1 12

Sheep 1 1

Vegetables 1 33

0

0.5

1

1.5

2

2.5

3

3.5

No of people

Isiqalo training, business plans and

income from business