Enterprise Development (ED) &

Climate

25 February 2020

Resilient Agriculture

N. Dlamini

Structure of discussion

1. What we do at Mahlathini DF

2. Purpose for this discussion

3. The problem

4. The solution

5. MDF’s experience

6. Results

7. Next steps

2

What we do at

Mahlathini DF

3

4

Programme

Target

Climate change

adaptation production

methodsthat improve

yields(qualityand

quantities)while

rehabilitating and

conservingthe

environment(soiland

water resources)

SmallholderFarmers

Trainingand

supervision of Farmer

LearningGroups

PromotionofCRA

§Improved soil

fertility

§Climate change

adaptable financial

planning habits

§Cooperative buying

§Increased yields

§Functional farmer

institutions

§Improved market

access

§Farmer centres

Results

Methodology

Goal

§CRAfarming

methods

§Financial Education

(Focused Savings

Groups)

§Entrepreneurship

Education (Street

Business School)

§Research (M&E)

Philosophical

underpinnings

Adapt financial

education and

enterprise

developmentto

meetthe

development

objectivesof

Climate Resilient

Agriculture (CRA)

§Just like a

wellness

programme, our

approach aims to

move people along

the awareness-

education-

behaviour-

continuum so that

they can operate:

5

Operate Farmer

Learning Groups

Operate Savings

Groups

Draw benefits

from CRA

practice

Operate profitable

enterprise

Improved natural

resource

management

Water

Soil health

Increased yields

Better equipped to

respond to CC

Purpose of this

discussion

6

The purpose of this discussion is to:

§Share MDF’s experience ins helping

the Farmer Learning Groups (FLGs)

to operate Savings Groups (SGs) in

ways that avail cash to finance the

business initiatives within the

boundaries of CRA

§Secure interest from farmers and

agree on next steps

Our problems (general)

§Scarcity of money

§Bad reputation of traditional stokvels

§Flooded by debt instruments and pre-paid

consumer products and services

§Prioritizeconsumptionoverproductiveassetsand

farming inputs

§Household food production at its lowest

§Discouraged youth in farming

§Negative effect of climate change are with us;

mainly, erosion, poor soil health and low yields

8

Debt Problem

Cash purchase price: R2 000.00

Instalment purchase price: R5 240.00

Deposit: R200 (10%)

Instalments: R140 X 36 months

Totalamountpaid:R5240

Totalinterestpaid:R3240(162%)

9

Food over-stocking problem

§Traditional

grocery stokvels

mobilise

members to

spend millions of

food at the end of

each year

Problem of instant gratification

§Non-productive

assets feed instant

gratification brain

Problem of fattening loan sharks

§Welovethemost

expensive money and

complain about debt and

scrupulous loan sharks in

one sentence

Problem of ignoring productive assets

Problem of ignoring lessons from stokvels

§Bad and good experiences in

stokvels

§All experiences are lessons

§Opportunity to extract

positives from stokvels and

transform Savings Groups to

financiers of rural

enterprises

Greatest opportunity

15

Promoting

Savings

Groups helps

to make CRA

practical in

communities

§Our

experience

16

Plugging the gaps

17

Food production, food security, improved

incomes, etc.

Access to capital

Networks that ease access to

organic food markets

Improved and

sustainable livelihoods

CCA

CRA

Rules of engagement: social bonds of association

All members of a Savings Group must know and trust each other

very well –and trust is reinforced by:

§A constitution

§Steel/strong tin money box

§3 way locked money box

§Clean records

18

Rules of engagement: transparency

§The meeting shall dispose minimum of 5

items in the following order:

1. Share purchase (savings)

2. Loan repayment

3. Issuing of new loans

4. Booking of future loans

5. Set date, time and venue of the next

meeting

19

Money box is opened in a meeting and all monies are counted in front of all

members

Share purchase

§Members shall agree on a minimum value of a share

§A sharemaybesetfromR100upwardsdependingonthe

affordability of the members /in multiples of R100

§All members must at least afford the minimum share

§Members shall be allowed to purchase between 1–10 shares in a

meeting

20

R100

§2 shares = R200

§4 shares = R400

R200

§2 shares = R400

§4 shares = R800

R500

§2 shares = R1 000

§4 shares = R2 000

Loan taking

§Loans are booked at the previous meeting

§No loans are granted to absent members

§No loans are granted to indebted members

§Loans shall not exceed 2 times of the value of member’s

shares E.G. a member with R1 000 is eligible for up to R2 000

§10% interest per month is charged

§3 months repayment period

§No interest charged on month 4

21

Group fund building fines

§Fines should be established for misbehaving members

§Funds raised from the fines shall be added into the Group Fund.

§No member shall be fined for failing to buy shares or repay a

loan.

§The group agree on the list of offences and fines:

uArriving 15 minutes late at a meeting

uForgettingkeys(Thismustneverhappen!)

uForgettingamoneybox(Thismustneverhappen!)

uForgetting the balances of the previous meeting

uTalkingduringthemeeting

uCell phone ringing during the meeting

uAnswering a cell phone during the meeting22

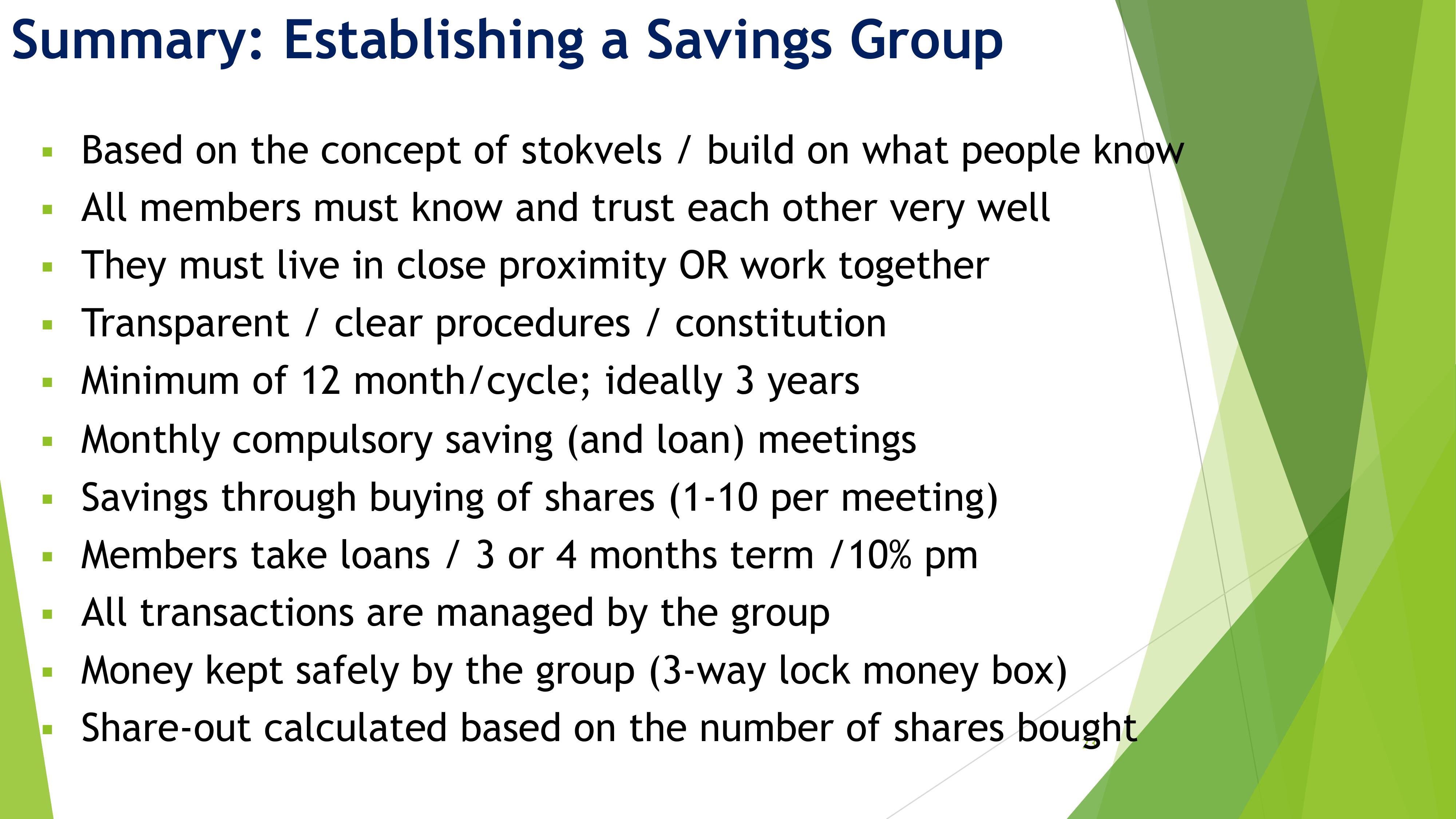

Summary: Establishing a Savings Group

23

§Based on the concept of stokvels / build on what people know

§All members must know and trust each other very well

§They must live in close proximity OR work together

§Transparent / clear procedures / constitution

§Minimum of 12 month/cycle; ideally 3 years

§Monthly compulsory saving (and loan) meetings

§Savings through buying of shares (1-10 per meeting)

§Members take loans / 3 or 4 months term /10% pm

§All transactions are managed by the group

§Money kept safely by the group (3-way lock money box)

§Share-out calculated based on the number of shares bought

Pillars of a Savings Group

§Manageable size of the group (up to 19)

§Trust, neighbourly, care for one another

§Strong social bonds

§Transparency,commitmentanddemocraticprinciples

§Focused savings to support CRA objectives

§On-going training and supervision

24

Key lessons

nIncreased circulation of cash in the village

nStarving of debt (loan sharks in particular)

nMoney freed for productive objectives / agri-business financier

nBasis for co-operative buying

nSolid foundation for enterprise development

nImproved networking skills on the part of farmers / secure

services and support agri value chain actors and supports

25

nA Savings Group is a “community bank”, but a bank that

requires no proof of income, payslip, identity document,

collateral, etc. to provide financial services

Results

nCash is available locally (R142 493.50)

nEasily available money to operate an

enterprise (8 members able to finance

1ha of maize production; R10K)

nMoney freed for production

nIncreased social capital and bonding of

members / act as a glue

nWomen empowerment, confidence

nFLG + SG = social insurance

26

§Enterprise Development

§A StreetBusinessSchool

Approach

27

28

Our goal is to invest savings in production

We use SBS to respond to dissect business

development and networks

5 fingers:

1. Market

2. Technical knowledge and skills

3. Capital

4. Profit

5. Family expenses

29

Trainingapproach

§8 short practical modules

§Financial education; and emphasis on

delayed gratification

§Continuous training, supervision and

on the ground business coaching

§Promote CRA commodities

30

Main concept

A bright future

exits for everyone

31

Financial and economic terms simplified

§Microfinance: strengthened relationship

between people and money in ways that

finance “money making resources”

§Enterprise Development: capacity to employ

available money making resources to improve

and sustain household incomes – where money

making resource are: entrepreneur, skills,

assets and money32

Conclusion

33

Farmer Learning

Groups

Savings Groups Production

Natural Resource

Management

Next Steps

Thank you

34