VILLAGE LOCAL

SAVINGS

ASSOCIATIONS (VSLA)

By Temakholo Mathebula

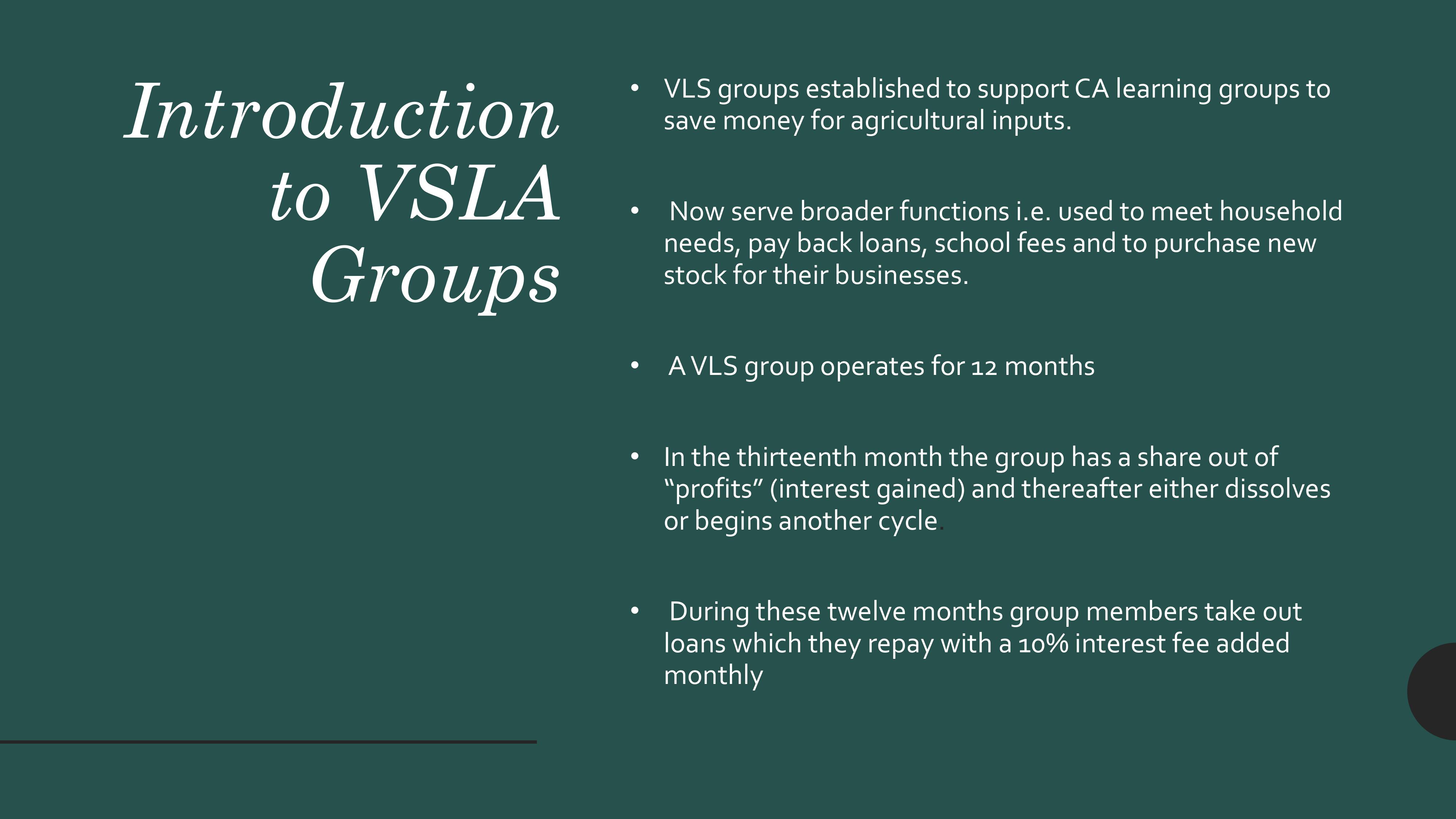

Introduction

to VSLA

Groups

•VLS groups establishedto support CA learning groups to

save money for agricultural inputs.

•Now serve broader functions i.e. used to meet household

needs, pay back loans, school fees and to purchase new

stock for their businesses.

•A VLS group operates for 12 months

•In the thirteenth month the group has a share out of

“profits” (interest gained) and thereafter either dissolves

or begins another cycle.

•During these twelve months group members take out

loans which they repay with a 10% interest fee added

monthly

Groups

Established

and

Supported

by MDF

•Bergville: 15 groups between 1 and 7 years operational

•Creighton: 2 Groups between 1 and 2 years operational

•Nokweja: 1 Group, 2 years operational

Twelve groups visited in April for annual review in

Bergville to monitor progress and address challenges.

Table 1: Total Shares and Cumulative Shares (April 2019)

No

Name of Group

# SHARES

BOUGHT

TODAY

VALUE OF

SHARES

(TODAY)

CUM # OF

SHARES

VALUE OF TOTAL

SHARES

1

Sizakahle

36

R3,600

61

R6,100

2

Inyonyana

41

R4,100

270

R27,000

3

Isibonelo

72

R7,200

430

R43,000

4

Masibambane

80

R8,000

474

R47,400

5

Masithuthuke

74

R7,400

406

R40,600

6

Mbalenhle

73

R7,300

375

R37,500

7

Mphelandaba

22

R2,200

126

R12,600

8

Sakhokuhle

49

R4,900

342

R34,200

9

uMntwana

100

R10,000

445

R44,500

10

Vukuzenzele

72

R7,200

310

R31,000

11

eZIbomvini

52

R5,200

249

R24,900

12

Ukhamba

43

R4,300

192

R19,200

TOTAL 714

R71,400

3680

R368,000

Bergville

Annual

Review

Summary

Contd

•Groups met in the first and second week of April for savings.

•Twelve groups visited saved R 71 400 with a total cumulative

amount of R 368 000.

•Total loans repaid R 44 690, new loans R 86 400, existing loans R

304 550 and total amount due including new and existing loans

came to R 446 690.

The total amount of new loans and total amount owed increased

from 2018 to 2019.

Group Name

LOAN

REPAID

TODAY

EXISTING

LOANS

NEW LOAN

TAKEN

AMOUNT DUE

NEXT MONTH

1

Sizakahle

R450

R2,300

R4,000

R6,930

2

Inyonyana

R6,010

R25,800

R6,000

R35,080

3

Isibonelo

R4,260

R42,300

R11,500

R59,460

4

Masibambane

R5,660

R41,300

R2,000

R47,830

5

Masithuthuke

R4,600

R4,600

R6,000

R37,400

6

Mbalenhle

R4,170

R35,900

R11,400

R52,630

7

Mphelandaba

R1,580

R12,450

R3,900

R18,000

8

Sakhokuhle

R3,530

R35,300

R8,400

R48,950

9

uMntwana

R5,950

R36,800

R15,900

R56,080

10

Vukuzenzele

R3,730

R26,300

R11,000

R38,280

11

eZIbomvini

R2,690

R22,500

R24,750

12

Ukhamba

R1,970

R19,000

R6,300

R21,300

13

TOTAL

R44,600

R304,550

R86,400

R44690

Table 2: Total Loans Repaid, Loan Due and New Loans

Primary

Highlights

and

Challenges

All Groups

Successfully

Shared out for

2018

Reduced Inter

group conflict

Improved

adherence to

group

constitution

Low number of

people exiting

groups after

share out

HIGHLIGHTS

Irregular

meeting

attendance

Stacking of

loans

Disagreements

with regard to

loan issuing

CHALLENGES

SHARE-OUTS

•All of the groups have had their share-outs for 2018.

•. The biggest items on which share-out money is utilized

include furniture; fridges, wardrobes and televisions in

particular which were mentioned by 95 percent of the

members.

•Other uses include payment of school fees, groceries and

household renovations which were also mentioned by

more than 80 percent of the members of the savings

groups.

•A small percentage (5-10 %) used the money to purchase

agricultural inputs, i.e. fertiliser, seed and other

agriculture related products such as meat and eggs.

SHAREOUTS CONTD

NO

Village

GROUP NAME

YRS

NO. OF

MEMBER

S

NEW

SHARE

VALUE

TOTAL

AMOUNT

SHARED

OUT

MAX

AMOUN

T/MEMB

ER

MIN

AMOUNT/M

EMBER

AVERAGE

AMOUNT/

MEMBER

USES

1

Vimbukhalo

Ukhamba

2

20

R130.00

R75,000

R8,000

R0.00

R1,300

Inputs, school fees, cutlery, blankets,

renovations, furniture

2

Eqeleni

Masithuthuke

6

23

R130.00

R80,000

R7,800

R1,560

R3,680

Christmas and school clothes, new TV, tiles,

renovations

3

Eqeleni

Masibambane

5

25

R136.00

R79,698

R8,000

R700

R4,000

Fertiliser, LAN, Maize seed, lounge suite,

floor tiles

4

Stulwane

uMntwana

7

36

R130.00

R140,000

R7,500

R1,200

R3,200

Inputs, furniture, other household needs

5

Stulwane

Mbalenhle

2

20

R149.00

R108,000

R9,000

R1,600

R5,000

Electricity installation, furniture, serviced

debts, business stock, groceries

6

Ngoba

Sakhokuhle

3

23

R145.00

R105,000

R8,000

R3,500

R3,500

smart phones, clothing, fertiliser, seed,

wardrobe, building material, fencing

7

Ngoba

Isibonelo

3

30

R152.00

R100,000

R9,000

R1,200

R4,000

Wedding celebration, furniture, livestock,

groceries, investments

8

Bethany

Gudlintaba

3

20

R161.00

R86,070

R9,600

R1,400

R4,500

New stock for meat business (tripe), eggs to

sell, poultry, medical bills,College fees

9

Vimbukhalo

Inyonyana

3

20

R130.00

R41,210

R3,770

R780

R1,950

Furniture, groceries, school fees

10

Ezibomvini

Ukuzama

3

21

R125.00

R23,375

R3,375

R2,000

R2,000

Inputs, household needs

11

Ndunwana

Mphelandaa

3

20

R149.00

R41,610

R3,576

R700

R2,200

Christmas and school clothes, renovations

TOTAL

258

R879,963

SUMMARY

•Majority of the savings group members are unemployed and therefore whatever

income they receive goes towards supporting their families.

•Eleven Groups were asked about share-out during the review and most said that

everything went well and they were satisfied with what they got.

•The groups visited distributed a total of R 879 963.00 amongst 258 members

•Majority of the groups had a share increase value ranging between 25 and 49 percent.

•Two out of the eleven groups managed to achieve a share increase percentage above

50% which somehow shows that despite concerted efforts to increase interest, the

reality of a lack of money will always override those efforts as the current model

simply gives back what the members put in and is most cases it is not much.

STREET

BUSINESS

SCHOOL

(SBS)

What Is SBS?

•SBS is a small business development program which places

emphasis on coaching, rather than training, therefore

program more suitable for people who are already doing

something.

Ezibomvini Farmer Centre

SBS:

8 ModulesModule 1: Getting out of your

comfort zone

Module 2: How to start a business

enterprise

Module 3: Finding Capital

Module 4: Record keeping

Module 5:Market Research

Module 6: Business Planning

Module 7: How to grow your

customer base

Module 8:Money Management

PRIMARY OBJECTIVE

PROGRESS

Bergville: modules 1 to 8 have been completed with around 30 participants interested in

establishing new or growing existing enterprises.

Deepen business management skills of participants by sharing combined experiences.